When it was announced, Verizon’s $23 billion planned investment in the service, called FiOS, was met by a chorus of skeptics, both on Wall Street and among rivals.

Everyone understood that the copper wires of the phone system were being left behind by the faster networks of the cable industry. But why spend so much money on new wires when cellphones are becoming ubiquitous and profitable? Verizon rejected cheaper alternatives and decided to build the fiber system at an estimated cost of about $4,000 for every customer.

Now, as Verizon begins to roll out FiOS in its hometown, New York, the company argues that the service is proving to be more successful than it promised when it started the project.

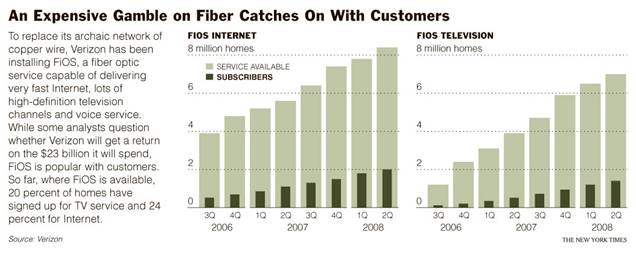

Despite prices that average well above $130 for a bundle of Internet, TV and voice services, 20 percent of the homes where FiOS is available have signed up for its video service, and 24 percent buy the Internet service, which offers speeds up to five times faster than cable competitors.

“I have yet to see a market where penetration has stopped growing,” said Robert J. Barish, Verizon’s senior vice president and the chief financial officer of its wired communications division. The cost to run the fiber through neighborhoods is also falling below $760 per home passed, Verizon’s initial estimate. (The company spends an extra $650 in equipment and labor to hook up each house ordering the service.)

Still, it might be a decade before anyone really knows whether Verizon’s bet on FiOS is a smart investment in the future or a multibillion-dollar black hole.

The company has had to spend more than it would like on advertising and expensive giveaways, like flat-screen TVs, to get new customers. Comcast and other cable companies are preparing to bolster their own Internet speeds and digital offerings.

In many ways, the long-term success of FiOS will depend on what new services are developed that will take advantage of the vast bandwidth of the fiber and how much customers will pay for them.

Mr. Barish argues that by spending now on the fiber network, Verizon will save a lot of money moving forward. And unlike its competitors, Verizon will not need further upgrades to offer faster data speeds or more HDTV channels.

“The network we are putting in is pretty future-proof,” he said. Also, “if we weren’t doing FiOS, we would have invested a lot more money in our core network. We haven’t needed to do that.”

Verizon’s logic is starting to convince investors, especially when compared with the cheaper approach taken by AT&T, the nation’s other large phone company. AT&T is relying on pumping more data through copper wires, but the company’s technology has taken longer than expected to develop and appears to have far less capacity to deliver HDTV than FiOS.

“There was a raging debate a couple of years ago about who got it right, AT&T or Verizon,” said Blair Levin, an analyst with Stifel, Nicolaus & Company. “Initially the investment community thought it was AT&T, but increasingly Verizon got their begrudging respect.”

Verizon’s stock, which lagged AT&T’s after FiOS was first announced, is now performing better. From 2005 to the end of 2006, Verizon’s shares fell by 4.6 percent, while AT&T’s shares rose by 38.7 percent in the same period. From the beginning of 2007 to now, Verizon has outperformed, with its shares falling 6.3 percent, better than the 12.2 percent decline of AT&T.

As of the end of the second quarter, there were 1.4 million FiOS television customers, up from 515,000 a year ago. Verizon also had two million FiOS Internet customers, up from 1.1 million last year.

Despite that customer growth, some critics say the revenue structure of FiOS does not justify its high capital costs.

“If I were an auto dealer and I wanted to give people a Maserati for the price of a Volkswagen, I’d have some seriously happy customers,” said Craig Moffett, an analyst with Sanford C. Bernstein. “My problem would be whether I could earn a decent return doing it.”

In a recent report, Mr. Moffett, one of Verizon’s most persistent critics, walked his clients through detailed projections of how much Verizon would earn from FiOS and how much it would save because the fiber network is cheaper to maintain than the old copper wires. He concluded that Verizon would be $6 billion in the hole when all was said and done.

Other analysts have reached different conclusions from the available data. Christopher Larsen of Credit Suisse calculates that if Verizon can get at least 20 percent of the potential customers to sign up for FiOS video, it will earn an acceptable profit.

And David Barden of Banc of America Securities argues that, for new Verizon investors, the return on Verizon’s original investment does not matter.

“If you are an investor today thinking about what the prospects of FiOS are tomorrow, you don’t look at what has been spent. You look at what needs to be spent,” Mr. Barden said. “The 2008 investors owe the 2003 investors a debt of gratitude because the 2008 Verizon is in a vastly better competitive position than it otherwise would be.”

Even if Mr. Moffett is right and Verizon comes out $6 billion behind on FiOS, that amount is almost lost in a company that has annual revenue of nearly $100 billion and spends $17 billion a year on capital improvements. Indeed, Verizon is dominated by wireless and business services. Service over wires to people’s homes makes up only 15 percent of its revenue.

One option that Verizon did not find palatable was just sitting still. Voice telephone lines are headed toward extinction, dropping 8.5 percent in the last year alone. And the speed of the digital subscriber line, or D.S.L., technology used to offer Internet service over copper wires has topped out at three megabits a second for many customers.

Meanwhile, cable companies like Comcast and Time Warner have been very successful in bundling Internet-based phone service with lots of TV channels and high-speed Internet service of 6 to 12 megabits a second. As consumers have demanded more video in their living rooms and on their computers, the cable companies have gained market share.

With FiOS offering current top Internet speeds of 50 megabits a second and a large menu of video offerings, Verizon is betting its packages will allow it to leapfrog over its cable rivals. Moreover, Verizon’s fiber network has the capacity to add more data speed, video channels and other services without rewiring.

The service has been particularly popular among the more sophisticated customers attracted by higher Internet speeds, said Karl Bode, the editor of BroadbandReports.com.

“Deliver quality technology and cutting-edge speed, and customers respond,” he said. “I’m preparing to move into a new home, and FiOS availability actually played a part in where I was willing to move. And I’ve probably been one of Verizon’s most outspoken critics over the years.”

The cable systems, in turn, are responding by cutting prices on voice service and developing new technology that can match the data speeds of FiOS and cram in more TV channels.

AT&T’s less radical approach essentially seeks to match, rather than surpass, the speed of cable’s Internet service. And while AT&T’s Internet-based video service has some fancy features, it can transmit only one, eventually two, HDTV signals to each home at once.

Because it is using less mature technology than FiOS, AT&T’s upgrade has gotten off to a slow start. At the end of the second quarter, AT&T’s video service, called U-Verse, had 549,000 customers, up from only 51,000 a year earlier. That is just a bit more than 10 percent of the homes that could buy the service.

John Donovan, AT&T’s chief technology officer, said the company might string fiber optic cables to its customers’ homes in the future. But he argues that it was a smarter choice to try to get as much life out of the copper wire as possible, betting the cost of fiber will drop over time.

“The last thing we want to do is overdeploy fixed capacity into the ground where there is no recovery for being wrong by putting in too much,” he said. “The ideal way to deploy technology is on the last day as fast as possible, because it gets more capable and cheaper every day.”