|

THE MAGAZINE

September 2014

Profits Without Prosperity

by William Lazonick

Though corporate profits are high, and the stock market is booming,

most Americans are not sharing in the economic recovery. While the top

0.1% of income recipients reap almost all the income gains, good jobs

keep disappearing, and new ones tend to be insecure and underpaid.

One of the major causes: Instead of investing their profits in growth

opportunities, corporations are using them for stock repurchases. Take

the 449 firms in the S&P 500 that were publicly listed from 2003

through 2012. During that period, they used 54% of their earnings—a

total of $2.4 trillion—to buy back their own stock. Dividends absorbed

an extra 37% of their earnings. That left little to fund productive

capabilities or better incomes for workers.

Why are such massive resources dedicated to stock buybacks? Because

stock-based instruments make up the majority of executives’ pay, and

buybacks drive up short-term stock prices. Buybacks contribute to

runaway executive compensation and economic inequality in a major way.

Because they extract value rather than create it, their overuse

undermines the economy’s health. To restore true prosperity to the

country, government and business leaders must take steps to rein them

in.

Five years after the official end of the Great Recession, corporate

profits are high, and the stock market is booming. Yet most Americans

are not sharing in the recovery. While the top 0.1% of income

recipients—which include most of the highest-ranking corporate

executives—reap almost all the income gains, good jobs keep

disappearing, and new employment opportunities tend to be insecure and

underpaid. Corporate profitability is not translating into widespread

economic prosperity.

The allocation of corporate profits to stock buybacks deserves much of

the blame. Consider the 449 companies in the S&P 500 index that were

publicly listed from 2003 through 2012. During that period those

companies used 54% of their earnings—a total of $2.4 trillion—to buy

back their own stock, almost all through purchases on the open market.

Dividends absorbed an additional 37% of their earnings. That left very

little for investments in productive capabilities or higher incomes

for employees.

The buyback wave has gotten so big, in fact, that even

shareholders—the presumed beneficiaries of all this corporate

largesse—are getting worried. “It concerns us that, in the wake of the

financial crisis, many companies have shied away from investing in the

future growth of their companies,” Laurence Fink, the chairman and CEO

of BlackRock, the world’s largest asset manager, wrote in an open

letter to corporate America in March. “Too many companies have cut

capital expenditure and even increased debt to boost dividends and

increase share buybacks.”

Why are such massive resources being devoted to stock repurchases?

Corporate executives give several reasons, which I will discuss later.

But none of them has close to the explanatory power of this simple

truth: Stock-based instruments make up the majority of their pay, and

in the short term buybacks drive up stock prices. In 2012 the 500

highest-paid executives named in proxy statements of U.S. public

companies received, on average, $30.3 million each; 42% of their

compensation came from stock options and 41% from stock awards. By

increasing the demand for a company’s shares, open-market buybacks

automatically lift its stock price, even if only temporarily, and can

enable the company to hit quarterly earnings per share (EPS) targets.

As a result, the very people we rely on to make investments in the

productive capabilities that will increase our shared prosperity are

instead devoting most of their companies’ profits to uses that will

increase their own prosperity—with unsurprising results. Even when

adjusted for inflation, the compensation of top U.S. executives has

doubled or tripled since the first half of the 1990s, when it was

already widely viewed as excessive. Meanwhile, overall U.S. economic

performance has faltered.

If the U.S. is to achieve growth that distributes income equitably and

provides stable employment, government and business leaders must take

steps to bring both stock buybacks and executive pay under control.

The nation’s economic health depends on it.

From Value Creation to Value Extraction

For three decades I’ve been studying how the resource allocation

decisions of major U.S. corporations influence the relationship

between value creation and value extraction, and how

that relationship affects the U.S. economy. From the end of World War

II until the late 1970s, a retain-and-reinvest approach to

resource allocation prevailed at major U.S. corporations. They

retained earnings and reinvested them in increasing their

capabilities, first and foremost in the employees who helped make

firms more competitive. They provided workers with higher incomes and

greater job security, thus contributing to equitable, stable economic

growth—what I call “sustainable prosperity.”

This pattern began to break down in the late 1970s, giving way to a

downsize-and-distribute regime of reducing costs and then

distributing the freed-up cash to financial interests, particularly

shareholders. By favoring value extraction over value creation, this

approach has contributed to employment instability and income

inequality.

As documented by the economists Thomas Piketty and Emmanuel Saez, the

richest 0.1% of U.S. households collected a record 12.3% of all U.S.

income in 2007, surpassing their 11.5% share in 1928, on the eve of

the Great Depression. In the financial crisis of 2008–2009, their

share fell sharply, but it has since rebounded, hitting 11.3% in 2012.

Since the late 1980s, the largest component of the income of the top

0.1% has been compensation, driven by stock-based pay. Meanwhile, the

growth of workers’ wages has been slow and sporadic, except during the

internet boom of 1998–2000, the only time in the past 46 years when

real wages rose by 2% or more for three years running. Since the late

1970s, average growth in real wages has increasingly lagged

productivity growth. (See the exhibit “When Productivity and Wages

Parted Ways.”)

When Productivity and Wages Parted Ways

From 1948 to the mid-1970s, increases in productivity and wages went

hand in hand. Then a gap opened between the two.

Not coincidentally, U.S. employment relations have undergone a

transformation in the past three decades. Mass plant closings

eliminated millions of unionized blue-collar jobs. The norm of a

white-collar worker’s spending his or her entire career with one

company disappeared. And the seismic shift toward offshoring left all

members of the U.S. labor force—even those with advanced education and

substantial work experience—vulnerable to displacement.

To some extent these structural changes could be justified initially

as necessary responses to changes in technology and competition. In

the early 1980s permanent plant closings were triggered by the inroads

superior Japanese manufacturers had made in consumer-durable and

capital-goods industries. In the early 1990s one-company careers fell

by the wayside in the IT sector because the open-systems architecture

of the microelectronics revolution devalued the skills of older

employees versed in proprietary technologies. And in the early 2000s

the offshoring of more-routine tasks, such as writing unsophisticated

software and manning customer call centers, sped up as a capable labor

force emerged in low-wage developing economies and communications

costs plunged, allowing U.S. companies to focus their domestic

employees on higher-value-added work.

These practices chipped away at the loyalty and dampened the spending

power of American workers, and often gave away key competitive

capabilities of U.S. companies. Attracted by the quick financial gains

they produced, many executives ignored the long-term effects and kept

pursuing them well past the time they could be justified.

A turning point was the wave of hostile takeovers that swept the

country in the 1980s. Corporate raiders often claimed that the

complacent leaders of the targeted companies were failing to maximize

returns to shareholders. That criticism prompted boards of directors

to try to align the interests of management and shareholders by making

stock-based pay a much bigger component of executive compensation.

Given incentives to maximize shareholder value and meet Wall Street’s

expectations for ever higher quarterly EPS, top executives turned to

massive stock repurchases, which helped them “manage” stock prices.

The result: Trillions of dollars that could have been spent on

innovation and job creation in the U.S. economy over the past three

decades have instead been used to buy back shares for what is

effectively stock-price manipulation.

Good Buybacks and Bad

Not all buybacks undermine shared prosperity. There are two major

types: tender offers and open-market repurchases. With the former, a

company contacts shareholders and offers to buy back their shares at a

stipulated price by a certain near-term date, and then shareholders

who find the price agreeable tender their shares to the company.

Tender offers can be a way for executives who have substantial

ownership stakes and care about a company’s long-term competitiveness

to take advantage of a low stock price and concentrate ownership in

their own hands. This can, among other things, free them from Wall

Street’s pressure to maximize short-term profits and allow them to

invest in the business. Henry Singleton was known for using tender

offers in this way at Teledyne in the 1970s, and Warren Buffett for

using them at GEICO in the 1980s. (GEICO became wholly owned by

Buffett’s holding company, Berkshire Hathaway, in 1996.) As Buffett

has noted, this kind of tender offer should be made when the share

price is below the intrinsic value of the productive capabilities of

the company and the company is profitable enough to repurchase the

shares without impeding its real investment plans.

But tender offers constitute only a small portion of modern buybacks.

Most are now done on the open market, and my research shows that they

often come at the expense of investment in productive capabilities

and, consequently, aren’t great for long-term shareholders.

Companies have been allowed to repurchase their shares on the open

market with virtually no regulatory limits since 1982, when the SEC

instituted Rule 10b-18 of the Securities Exchange Act. Under the rule,

a corporation’s board of directors can authorize senior executives to

repurchase up to a certain dollar amount of stock over a specified or

open-ended period of time, and the company must publicly announce the

buyback program. After that, management can buy a large number of the

company’s shares on any given business day without fear that the SEC

will charge it with stock-price manipulation—provided, among other

things, that the amount does not exceed a “safe harbor” of 25% of the

previous four weeks’ average daily trading volume. The SEC requires

companies to report total quarterly repurchases but not daily ones,

meaning that it cannot determine whether a company has breached the

25% limit without a special investigation.

Despite the escalation in buybacks over the past three decades, the

SEC has only rarely launched proceedings against a company for using

them to manipulate its stock price. And even within the 25% limit,

companies can still make huge purchases: Exxon Mobil, by far the

biggest stock repurchaser from 2003 to 2012, can buy back about $300

million worth of shares a day, and Apple up to $1.5 billion a day. In

essence, Rule 10b-18 legalized stock market manipulation through

open-market repurchases.

The rule was a major departure from the agency’s original mandate,

laid out in the Securities Exchange Act in 1934. The act was a

reaction to a host of unscrupulous activities that had fueled

speculation in the Roaring ’20s, leading to the stock market crash of

1929 and the Great Depression. To prevent such shenanigans, the act

gave the SEC broad powers to issue rules and regulations.

During the Reagan years, the SEC began to roll back those rules. The

commission’s chairman from 1981 to 1987 was John Shad, a former vice

chairman of E.F. Hutton and the first Wall Street insider to lead the

commission in 50 years. He believed that the deregulation of

securities markets would channel savings into economic investments

more efficiently and that the isolated cases of fraud and manipulation

that might go undetected did not justify onerous disclosure

requirements for companies. The SEC’s adoption of Rule 10b-18

reflected that point of view.

Debunking the Justifications for Buybacks

Executives give three main justifications for open-market repurchases.

Let’s examine them one by one:

1. Buybacks are investments in our undervalued shares that signal our

confidence in the company’s future.

This makes some sense. But the reality is that over the past two

decades major U.S. companies have tended to do buybacks in bull

markets and cut back on them, often sharply, in bear markets. (See the

exhibit “Where Did the Money from Productivity Increases Go?”) They

buy high and, if they sell at all, sell low. Research by the

Academic-Industry Research Network, a nonprofit I cofounded and lead,

shows that companies that do buybacks never resell the shares at

higher prices.

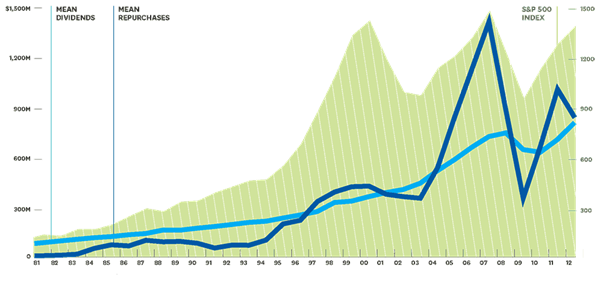

Where Did the Money from Productivity Increases Go?

Buybacks—as well as dividends—have skyrocketed in the past 20 years.

(Note that these data are for the 251 companies that were in the S&P

500 in January 2013 and were public from 1981 through 2012. Inclusion

of firms that went public after 1981, such as Microsoft, Cisco, Amgen,

Oracle, and Dell, would make the increase in buybacks even more

marked.) Though executives say they repurchase only undervalued

stocks, buybacks increased when the stock market boomed, casting doubt

on that claim.

|

Source: Standard & Poor’s Compustat database; the

Academic-Industry Research Network.

Note: Mean repurchase and dividend amounts are in 2012 dollars. |

Once in a while a company that bought high in a boom has been forced

to sell low in a bust to alleviate financial distress. GE, for

example, spent $3.2 billion on buybacks in the first three quarters of

2008, paying an average price of $31.84 per share. Then, in the last

quarter, as the financial crisis brought about losses at GE Capital,

the company did a $12 billion stock issue at an average share price of

$22.25, in a failed attempt to protect its triple-A credit rating.

In general, when a company buys back shares at what turn out to be

high prices, it eventually reduces the value of the stock held by

continuing shareholders. “The continuing shareholder is

penalized by repurchases above intrinsic value,” Warren Buffett wrote

in his 1999 letter to Berkshire Hathaway shareholders. “Buying dollar

bills for $1.10 is not good business for those who stick around.”

2. Buybacks are necessary to offset the dilution of earnings per share

when employees exercise stock options.

Calculations that I have done for high-tech companies with broad-based

stock option programs reveal that the volume of open-market

repurchases is generally a multiple of the volume of options that

employees exercise. In any case, there’s no logical economic rationale

for doing repurchases to offset dilution from the exercise of employee

stock options. Options are meant to motivate employees to work harder

now to produce higher future returns for the company. Therefore,

rather than using corporate cash to boost EPS immediately, executives

should be willing to wait for the incentive to work. If the company

generates higher earnings, employees can exercise their options at

higher stock prices, and the company can allocate the increased

earnings to investment in the next round of innovation.

3. Our company is mature and has run out of profitable investment

opportunities; therefore, we should return its unneeded cash to

shareholders.

Some people used to argue that buybacks were a more tax-efficient

means of distributing money to shareholders than dividends. But that

has not been the case since 2003, when the tax rates on long-term

capital gains and qualified dividends were made the same. Much more

important issues remain, however: What is the CEO’s main role and his

or her responsibility to shareholders?

Companies that have built up productive capabilities over long periods

typically have huge organizational and financial advantages when they

enter related markets. One of the chief functions of top executives is

to discover new opportunities for those capabilities. When they opt to

do large open-market repurchases instead, it raises the question of

whether these executives are doing their jobs.

A related issue is the notion that the CEO’s main obligation is to

shareholders. It’s based on a misconception of the shareholders’ role

in the modern corporation. The philosophical justification for giving

them all excess corporate profits is that they are best positioned to

allocate resources because they have the most interest in ensuring

that capital generates the highest returns. This proposition is

central to the “maximizing shareholder value” (MSV) arguments espoused

over the years, most notably by Michael C. Jensen. The MSV school also

posits that companies’ so-called free cash flow should be distributed

to shareholders because only they make investments without a

guaranteed return—and hence bear risk.

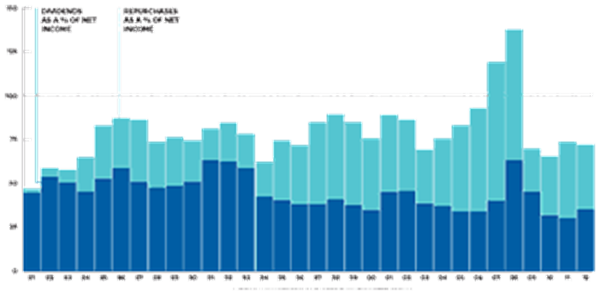

Why Money for Reinvestment Has Dried Up

Since the early 1980s, when restrictions on open-market buybacks were

greatly eased, distributions to shareholders have absorbed a huge

portion of net income, leaving much less for reinvestment in

companies.

|

Note: Data are for

the 251 companies that were in the S&P 500 Index in January 2013

and were publicly listed from 1981 through 2012. If the

companies that went public after 1981, such as Microsoft, Cisco,

Amgen, Oracle, and Dell, were included, repurchases as a

percentage of net income would be even higher. |

But the MSV school ignores other participants in the economy who bear

risk by investing without a guaranteed return. Taxpayers take

on such risk through government agencies that invest in infrastructure

and knowledge creation. And workers take it on by investing in

the development of their capabilities at the firms that employ them.

As risk bearers, taxpayers, whose dollars support business

enterprises, and workers, whose efforts generate productivity

improvements, have claims on profits that are at least as strong as

the shareholders’.

The irony of MSV is that public-company shareholders typically never

invest in the value-creating capabilities of the company at all.

Rather, they invest in outstanding shares in the hope that the stock

price will rise. And a prime way in which corporate executives fuel

that hope is by doing buybacks to manipulate the market. The only

money that Apple ever raised from public shareholders was $97 million

at its IPO in 1980. Yet in recent years, hedge fund activists such as

David Einhorn and Carl Icahn—who played absolutely no role in the

company’s success over the decades—have purchased large amounts of

Apple stock and then pressured the company to announce some of the

largest buyback programs in history.

The past decade’s huge increase in repurchases, in addition to high

levels of dividends, have come at a time when U.S. industrial

companies face new competitive challenges. This raises questions about

how much of corporate cash flow is really “free” to be distributed to

shareholders. Many academics—for example, Gary P. Pisano and Willy C.

Shih of Harvard Business School, in their 2009 HBR article

“Restoring

American Competitiveness” and their book

Producing

Prosperity—have warned that if U.S. companies don’t

start investing much more in research and manufacturing capabilities,

they cannot expect to remain competitive in a range of advanced

technology industries.

Retained earnings have always been the foundation for investments in

innovation. Executives who subscribe to MSV are thus copping out of

their responsibility to invest broadly and deeply in the productive

capabilities their organizations need to continually innovate. MSV as

commonly understood is a theory of value extraction, not value

creation.

Executives Are Serving Their Own Interests

As I noted earlier, there is a simple, much more plausible explanation

for the increase in open-market repurchases: the rise of stock-based

pay. Combined with pressure from Wall Street, stock-based incentives

make senior executives extremely motivated to do buybacks on a

colossal and systemic scale.

Consider the 10 largest repurchasers, which spent a combined $859

billion on buybacks, an amount equal to 68% of their combined net

income, from 2003 through 2012. (See the exhibit “The Top 10 Stock

Repurchasers.”) During the same decade, their CEOs received, on

average, a total of $168 million each in compensation. On average, 34%

of their compensation was in the form of stock options and 24% in

stock awards. At these companies the next four highest-paid senior

executives each received, on average, $77 million in compensation

during the 10 years—27% of it in stock options and 29% in stock

awards. Yet since 2003 only three of the 10 largest repurchasers—Exxon

Mobil, IBM, and Procter & Gamble—have outperformed the S&P 500 Index.

The Top 10 Stock Repurchasers 2003–2012

At most of the leading U.S. companies below, distributions to

shareholders were well in excess of net income. These distributions

came at great cost to innovation, employment, and—in cases such as oil

refining and pharmaceuticals—customers who had to pay higher prices

for products.

|

Sources: Standard &

Poor’s Compustat database; Standard & Poor’s Execucomp database;

the Academic-Industry Research Network.

Note: The percentages of stock-based pay include gains realized

from exercising stock options for all years plus, for 2003–2005,

the fair value of restricted stock grants or, for 2006–2012,

gains realized on vesting of stock awards. Rounding to the

nearest billion may affect total distributions and percentages

of net income. *Steven Ballmer, Microsoft’s CEO from January

2000 to February 2014, did not receive any stock-based pay. He

does, however, own about 4% of Microsoft’s shares, valued at

more than $13 billion. |

Reforming the System

Buybacks have become an unhealthy corporate obsession. Shifting

corporations back to a retain-and-reinvest regime that promotes stable

and equitable growth will take bold action. Here are three proposals:

Put an end to open-market buybacks.

In a 2003 update to Rule 10b-18, the SEC explained: “It is not

appropriate for the safe harbor to be available when the issuer has a

heightened incentive to manipulate its share price.” In practice,

though, the stock-based pay of the executives who decide to do

repurchases provides just this “heightened incentive.” To correct this

glaring problem, the SEC should rescind the safe harbor.

A good first step toward that goal would be an extensive SEC study of

the possible damage that open-market repurchases have done to capital

formation, industrial corporations, and the U.S. economy over the past

three decades. For example, during that period the amount of stock

taken out of the market has exceeded the amount issued in almost every

year; from 2004 through 2013 this net withdrawal averaged $316 billion

a year. In aggregate, the stock market is not functioning as a source

of funds for corporate investment. As I’ve already noted, retained

earnings have always provided the base for such investment. I believe

that the practice of tying executive compensation to stock price is

undermining the formation of physical and human capital.

Rein in stock-based pay.

Many studies have shown that large companies tend to use the same set

of consultants to benchmark executive compensation, and that each

consultant recommends that the client pay its CEO well above average.

As a result, compensation inevitably ratchets up over time. The

studies also show that even declines in stock price increase executive

pay: When a company’s stock price falls, the board stuffs even more

options and stock awards into top executives’ packages, claiming that

it must ensure that they won’t jump ship and will do whatever is

necessary to get the stock price back up.

In 1991 the SEC began allowing top executives to keep the gains from

immediately selling stock acquired from options. Previously, they had

to hold the stock for six months or give up any “short-swing” gains.

That decision has only served to reinforce top executives’ overriding

personal interest in boosting stock prices. And because corporations

aren’t required to disclose daily buyback activity, it gives

executives the opportunity to trade, undetected, on inside information

about when buybacks are being done. At the very least, the SEC should

stop allowing executives to sell stock immediately after options are

exercised. Such a rule could help launch a much-needed discussion of

meaningful reform that goes beyond the 2010 Dodd-Frank Act’s “Say on

Pay”—an ineffectual law that gives shareholders the right to make

nonbinding recommendations to the board on compensation issues.

But overall the use of stock-based pay should be severely limited.

Incentive compensation should be subject to performance criteria that

reflect investment in innovative capabilities, not stock performance.

Transform the boards that determine executive compensation.

Boards are currently dominated by other CEOs, who have a strong bias

toward ratifying higher pay packages for their peers. When approving

enormous distributions to shareholders and stock-based pay for top

executives, these directors believe they’re acting in the interests of

shareholders.

That’s a big part of the problem. The vast majority of shareholders

are simply investors in outstanding shares who can easily sell their

stock when they want to lock in gains or minimize losses. As I argued

earlier, the people who truly invest in the productive capabilities of

corporations are taxpayers and workers. Taxpayers have an interest in

whether a corporation that uses government investments can generate

profits that allow it to pay taxes, which constitute the taxpayers’

returns on those investments. Workers have an interest in whether the

company will be able to generate profits with which it can provide pay

increases and stable career opportunities.

It’s time for the U.S. corporate governance system to enter the 21st

century: Taxpayers and workers should have seats on boards. Their

representatives would have the insights and incentives to ensure that

executives allocate resources to investments in capabilities most

likely to generate innovations and value.

Courage in Washington

After the Harvard Law School dean Erwin Griswold published “Are Stock

Options Getting out of Hand?” in this magazine in 1960, Senator Albert

Gore launched a campaign that persuaded Congress to whittle away

special tax advantages for executive stock options. After the Tax

Reform Act of 1976, the compensation expert Graef Crystal declared

that stock options that qualified for the capital-gains tax rate,

“once the most popular of all executive compensation devices…have been

given the last rites by Congress.” It also happens that during the

1970s the share of all U.S. income that the top 0.1% of households got

was at its lowest point in the past century.

The members of the U.S. Congress should show the courage and

independence of their predecessors and go beyond “Say on Pay” to do

something about excessive executive compensation. In addition,

Congress should fix a broken tax regime that frequently rewards value

extractors as if they were value creators and ignores the critical

role of government investment in the infrastructure and knowledge that

are so crucial to the competitiveness of U.S. business.

Instead, what we have now are corporations that lobby—often

successfully—for federal subsidies for research, development, and

exploration, while devoting far greater resources to stock buybacks.

Here are three examples of such hypocrisy:

Alternative energy.

Exxon Mobil, while receiving about $600 million a year in U.S.

government subsidies for oil exploration (according to the Center for

American Progress), spends about $21 billion a year on buybacks. It

spends virtually no money on alternative energy research.

Meanwhile, through the American Energy Innovation Council, top

executives of Microsoft, GE, and other companies have lobbied the U.S.

government to triple its investment in alternative energy research and

subsidies, to $16 billion a year. Yet these companies had plenty of

funds they could have invested in alternative energy on their own.

Over the past decade Microsoft and GE, combined, have spent about that

amount annually on buybacks.

Nanotechnology.

Intel executives have long lobbied the U.S. government to increase

spending on nanotechnology research. In 2005, Intel’s then-CEO, Craig

R. Barrett, argued that “it will take a massive, coordinated U.S.

research effort involving academia, industry, and state and federal

governments to ensure that America continues to be the world leader in

information technology.” Yet from 2001, when the U.S. government

launched the National Nanotechnology Initiative (NNI), through 2013

Intel’s expenditures on buybacks were almost four times the total NNI

budget.

Pharmaceutical drugs.

In response to complaints that U.S. drug prices are at least twice

those in any other country, Pfizer and other U.S. pharmaceutical

companies have argued that the profits from these high prices—enabled

by a generous intellectual-property regime and lax price

regulation—permit more R&D to be done in the United States than

elsewhere. Yet from 2003 through 2012, Pfizer funneled an amount equal

to 71% of its profits into buybacks, and an amount equal to 75% of its

profits into dividends. In other words, it spent more on buybacks and

dividends than it earned and tapped its capital reserves to help fund

them. The reality is, Americans pay high drug prices so that major

pharmaceutical companies can boost their stock prices and pad

executive pay.Given the importance of the stock market and

corporations to the economy and society, U.S. regulators must step in

to check the behavior of those who are unable or unwilling to control

themselves. “The mission of the U.S. Securities and Exchange

Commission,” the SEC’s website explains, “is to protect investors,

maintain fair, orderly, and efficient markets, and facilitate capital

formation.” Yet, as we have seen, in its rulings on and monitoring of

stock buybacks and executive pay over three decades, the SEC has taken

a course of action contrary to those objectives. It has enabled the

wealthiest 0.1% of society, including top executives, to capture the

lion’s share of the gains of U.S. productivity growth while the vast

majority of Americans have been left behind. Rule 10b-18, in

particular, has facilitated a rigged stock market that, by permitting

the massive distribution of corporate cash to shareholders, has

undermined capital formation, including human capital formation.

The corporate resource allocation process is America’s source of

economic security or insecurity, as the case may be. If Americans want

an economy in which corporate profits result in shared prosperity, the

buyback and executive compensation binges will have to end. As with

any addiction, there will be withdrawal pains. But the best executives

may actually get satisfaction out of being paid a reasonable salary

for allocating resources in ways that sustain the enterprise, provide

higher standards of living to the workers who make it succeed, and

generate tax revenues for the governments that provide it with crucial

inputs.

A version of this article appeared in the

September 2014

issue of Harvard Business Review.

Copyright © 2016 Harvard

Business School Publishing

|