IN THE decade before America’s housing bubble burst, Home Depot, an American home-improvement chain, spent heavily on building new shops to meet rampant demand for everything from taps to timber. For every dollar of operating cashflow the firm generated, it ploughed back 65 cents into capital investment. The financial crisis hit hard, and demand for some products has yet to recover fully. Sales of kitchens are only 60% of their peak level. But Home Depot has evolved into a very different kind of beast. Its capital investment has fallen by two-thirds and it is investing heavily in something else: its own shares.

Since 2008 it has spent 28 cents of every dollar of cashflow on dividends and a further 52 cents on share repurchases. In June it took advantage of low interest rates to issue a $2 billion bond partly to pay for more buy-backs—a “great trade, these kind of opportunities don’t come often”, says Carol Tomé, the firm’s chief financial officer. She says that as more customers buy online, there is less need to invest in physical shops, and that using excess cashflow and cheap debt to repurchase stock creates value for investors. The stockmarket seems to agree: Home Depot’s shares have trebled since 2010 and are at an all-time high.

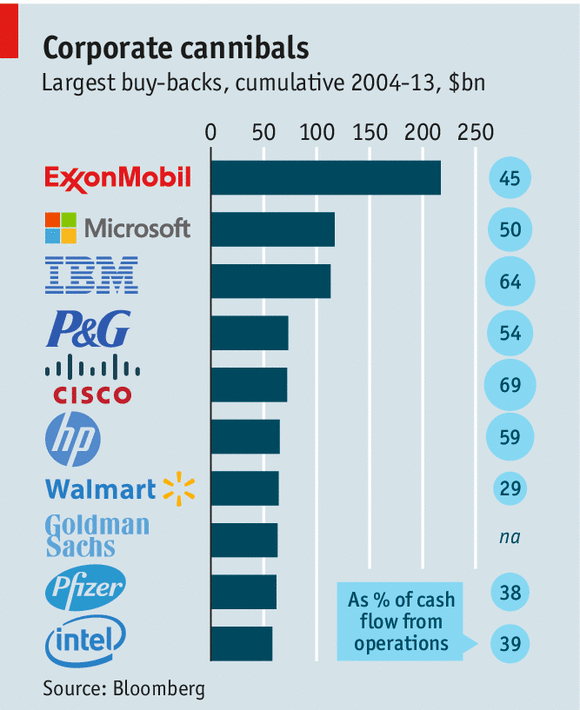

That story, of sluggish investment despite low interest rates, and huge share repurchases, is broadly true of all of corporate America. The companies in the S&P 500 index bought $500 billion of their own shares in 2013, close to the high reached in the bubble year of 2007, and eating up 33 cents of every dollar of cashflow. The greatest of America’s 19th-century tycoons, John Rockefeller, once said his sole pleasure was “to see my dividends coming in”, but buy-backs have usurped dividends as the main way listed American firms give money back to their owners, accounting for 60% of cash returns last year.

Even in Europe and Asia, where dividends tend to be venerated, buy-backs have become more common in the past decade. Tencent, a Chinese internet giant whose billionaire boss, Ma Huateng, has a seat in the National People’s Congress, now regularly repurchases its stock. The conservative champions of Japan, including Toyota, Mitsubishi and NTT DoCoMo, are buying their own shares at a record rate. Today no chief executive can ignore buy-backs. They are an idea that has conquered the world.

In a way, this is a victory for shareholders. Firms cannot now hoard cash or invest it sloppily. Instead they face a contest for resources with their owners, particularly those that are activist investors, says Michael Mauboussin of Credit Suisse, a bank. Even the haughtiest firms must dance to the piper’s tune. Apple, with the largest cash pile of any firm in the world, has faced heat from two feisty fund managers, Carl Icahn and David Einhorn. It now plans to buy back $130 billion-worth of shares between 2012 and 2015.

Yet share repurchases also have many critics. They fall into two camps. Some view buy-backs as a form of financial sorcery, on a par with all those abstruse credit derivatives that helped cause the financial crisis. Others accept that buy-backs are a legitimate way to return cash to shareholders but worry about their extent. They fear they have become a kind of corporate cocaine that induces a temporary feeling of invincibility but masks weakness and vacuity. They worry the boom will damage firms and the economy. “You have to save shareholders from themselves,” says the finance chief of one of the world’s biggest multinationals, who thinks there may be a buy-back bubble. Jim Chanos, a short-seller who helped expose the Enron scandal, says the rate at which firms are repurchasing their shares is reckless.

Eye of newt and toe of frog

The “sorcery” gibe has rich antecedents. Repurchases by firms in the open market, the main type of buy-backs today, used to be banned. America loosened its rules in 1982, Japan in 1994 and Germany in 1998. But the criticism seems excessive, given how similar buy-backs are to dividends.

The theory goes like this. When it buys its shares or pays a dividend, a firm is transferring cash to its owners. In neither case does this alter the underlying value of the firm, which is determined by its expected cash flows and their riskiness. Instead all that happens is that the financial instruments with a claim on those cash flows are reshuffled: the value of the firm’s equity declines, its cash falls (or debt rises) and investors’ cash holdings rise, all by an identical sum. In both cases, owners’ wealth is also unaffected: those who sell shares in a buy-back end up with more cash and fewer shares; those who do not end up with a bigger slice of a smaller pie.

The real world varies from what the textbooks say. Since interest paid on debt is tax-deductible, whereas interest earned on cash is taxable, by increasing its net debt to finance buy-backs or dividends, a firm cuts its tax bill. And of course, increasing the firm’s indebtedness makes it riskier. Buy-backs and dividends can also boost perceptions of a firm’s value if, say, investors had feared it might otherwise blow its excess cash on corporate jets, lavish new headquarters, exotic takeovers or other monuments to executive vanity.

|

|

Where buy-backs differ from dividends in theory and practice is that they do not treat shareholders identically: some sell, some do not. But executives are alarmingly muddled about this: they imagine they are able to time their companies’ share purchases, buying them when they are cheap to “create value” for all. Even Warren Buffett alluded to this in his 1984 letter to shareholders: “When companies with outstanding businesses and comfortable financial positions find their shares selling far below their intrinsic value in the market place, no alternative action can benefit shareholders as surely as repurchases.”

Sadly, this is a delusion. If a firm buys its stock at a price that, with the benefit of hindsight, is low, it transfers wealth from the shareholders who sold too cheaply to its continuing owners. It does not enhance shareholder value overall. Managers’ duty is, of course, to all shareholders.

In any case, managers in aggregate are about as good at predicting share prices as dart-throwing simians. Admittedly, studies show a mild “signalling” benefit to share prices when firms buy—perhaps because investors believe executives know more than they do. Indeed, says Theo Vermaelen of INSEAD, a French business school, little-studied small companies and technology firms with opaque product pipelines can sometimes judge their share prices better than the outside world.

Overall, though, executives are hopeless. This is amply illustrated by the fact that buy-backs last peaked in 2007, just before the crash, whereas few firms bought in 2009 when shares were dirt-cheap. In the six months to May 2008, as Lehman Brothers faced a cash crunch that would end in its bankruptcy, it blew $1 billion on buying its shares. In all, America’s financial sector repurchased $207 billion of shares between 2006 and 2008. By 2009 taxpayers had had to inject $250 billion into the banks to save them.

Even if the most extravagant boast about buy-backs—that firms can use them to create value through market timing—is flaky, they can still be a flexible cash-management tool. Aswath Damodaran of the Stern School of Business at New York University explains that they let firms vary their cash returns to shareholders as their profits oscillate. He sees dividends as a throwback to the 19th century, when investors insisted on bond-like payments.

Most well-run firms nowadays opt for a compromise. First, they invest cash in any projects likely to produce positive returns. Then they pay out a steadily growing dividend, which pension funds and life insurance firms tend to like. If any cashflow is left over in a given year, they use this to buy shares. What could be more sensible?

Addicted to the “pop”

However, buy-backs have a flaw: they can create perverse incentives to pay out too much cash, damaging firms’ balance-sheets and their ability to invest. For a start, both investors and managers can become addicted to the temporary “pop” that a buy-back can give to a share price. In a half-hearted effort to discourage this, there are rules to limit the rate at which firms can buy their stock—25% of daily trading volumes in America and Britain, for example. Some firms undoubtedly attempt to prop up their share prices in the short term. Hewlett-Packard, a computer firm, bought back shares heavily in 2011 even as its profits and prospects sank.

Pay plans can corrupt managers’ motives. By buying existing shares they can offset the effect of new ones created for their personal stock-option plans. Cash leaves the firm for their pockets without being booked as a cost or reducing earnings per share (EPS). Buy-backs can also give a superficial boost to EPS: the number of shares falls more than the decline in profits from higher interest costs. If managers are paid on the basis of EPS targets—as up to half of American bosses are—they have a temptation to go buy-back bananas.

Bad incentives have not been enough to push corporate America as a whole into reckless behaviour. Take the non-financial firms in the S&P 500 index last year. Their books roughly balanced: buy-backs, dividends and capital investment ate up 101% of operating cashflow. Their net debt was modest and stable relative to gross operating profits. Most have taken advantage of low interest rates to extend the maturity of their debts, making them safer, notes Jeff Meli of Barclays Bank.

Yet beneath the placid surface are nasty undercurrents. The aggregate figures for America are skewed by a few giant technology and pharmaceutical firms. Two-fifths of S&P 500 firms are spending more than their entire cashflow on dividends, capital investment and buy-backs, thereby increasing their net debt.

Buy-backs are weakening the balance-sheets even of the most cash-rich firms because of an oddity in American tax laws. Companies have to pay tax on foreign profits at the difference between America’s rate of 35% and whatever they paid in the foreign country (often 20% or less)—but only if they bring the proceeds back to America. So, they hoard this cash offshore. Microsoft, General Electric, Google, Apple, Pfizer, Coca-Cola and Johnson & Johnson, among others, hold the majority of their cash overseas. Those firms in the S&P 500 that deign to disclose this have $650 billion of cash overseas, or two-thirds of their total, says David Zion of ISI, a research firm.

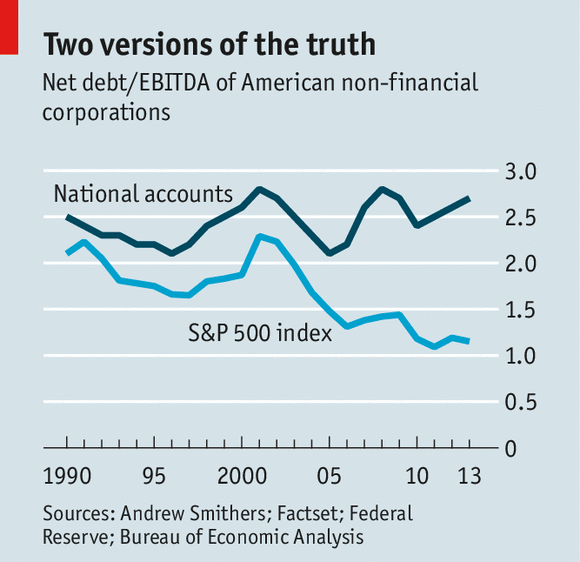

So, when such companies do buy-backs, their American operations bear the burden of borrowing to pay for them. The corporate accounts of listed American firms, which capture their global operations, suggest indebtedness is low. But the national accounts, which principally capture just the domestic operations of American firms, paint a much more alarming picture, says Andrew Smithers, an economist (see chart).

|

|

For strong companies the resultant behaviour is merely quirky. Last year Apple borrowed $12 billion at home to help fund buy-backs despite having $132 billion of cash sitting abroad. But weaker companies which habitually borrow at home to finance buy-backs may risk a liquidity crunch if debt markets dry up and they cannot rapidly get their paws on cash stashed abroad.

Some critics’ main beef about the buy-back boom is that it is leading firms to skimp on long-term investment. This has to be taken with a pinch of salt. Michael Porter, a celebrated management thinker, warned of America’s “failure” to invest in 1992, contrasting it with Japan, which shortly thereafter imploded thanks to its firms’ sloppy and excessive investment. Relative to sales, American firms’ investment has indeed been declining. But that could be because of a shift from manufacturing to services, and the rise of the digital and internet economy, which is inherently less capital-hungry.

Part of the frustration comes from policymakers, who had hoped ultra-low interest rates might stimulate corporate investment. But Jeremy Stein of Harvard University argues that buy-backs are not to blame: firms are unlikely to alter their long-term investment plans just because long term interest rates have been artificially pushed down. Mohamed El-Erian, an adviser to Allianz, an insurance firm, says firms are being sensible by restraining investment in the face of economic uncertainty, even as financial investors go wild, fuelled by central banks’ actions.

However, among fund managers and some executives, there is little doubt that the pressure to boost cash returns can contribute to low investment. Simon Henry, the finance chief of Shell, which invests more in absolute terms than any other European firm, says that investors like executives to feel a creative tension between the pull of capital investment, dividends and buy-backs. But that can spill into an irrational hunger for cash returns: “The longevity of the firm is what matters...executives need to hold their nerve against short-term pressure so that they can invest for the long run”.

In the end it will come down to what shareholders want. And here there are signs the buy-back boom is peaking. A survey of fund managers in July by Bank of America Merrill Lynch found an overwhelming majority thought firms were underinvesting—the strongest reading for at least a decade—and that few wanted even more cash returns.

There are even signs that investing may be back in fashion. Exxon, the biggest spender on buy-backs thus far, has recently tempered them in favour of long-term projects. Since 2012 Amazon has poured $3-4 billion a year into its distribution network. Its shares have soared. And on September 4th Tesla, a maker of electric cars, said it would build a $5 billion battery factory in Nevada. Its share price rose in response. It was a reminder that shareholder capitalism is still capable of moments when acts of creation, rather than changes to capital structures, induce euphoria.