|

Money

| Wed Apr 27, 2016 1:20am EDT

Investors want mutual funds to get tougher on CEO pay: Reuters/Ipsos

poll

BOSTON

|

By

Ross Kerber

|

The BlackRock sign

is pictured in the Manhattan borough of New York, in this

October 11, 2015 file photo. .

Reuters/Eduardo

Munoz |

Individual investors are angry about CEO pay, and they want their

mutual fund firms to do something about it.

Top money managers such as BlackRock Inc (BLK.N)

and Vanguard Group oversee trillions of dollars for individuals, but

the firms rarely challenge CEO pay in their proxy votes on behalf of

investors.

That

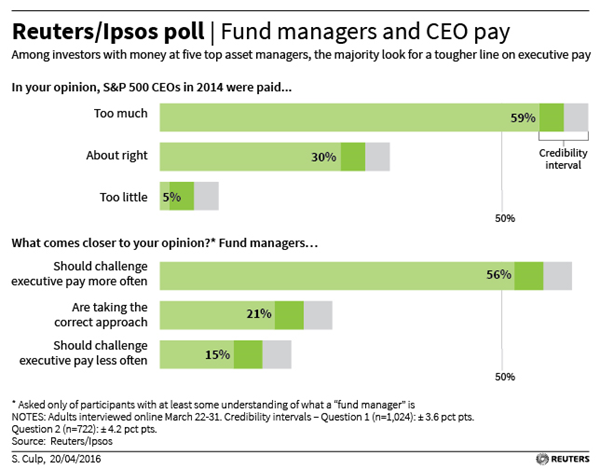

practice may not match well with the views of their clients. When asked

directly, most investors in American fund firms are critical of CEO pay

packages, according to a national Reuters/Ipsos poll.

Among

respondents, 59 percent said chief executives at S&P 500 companies were

paid "too much," and 56 percent said mutual fund firms "should challenge

executive pay more often."

The

survey was conducted between March 22 and March 31. It included 1,024

people who said they invested with one or more of five top asset managers

and 722 people who said they had at least some understanding of what a

fund manager is. It has a credibility interval of about 4 percentage

points.

For a

graphic showing the views of fund firm investors, see:

tmsnrt.rs/1XJ3gMy

The

poll results underscore a growing angst over large-company CEO pay, which

now runs more than 300 times that of U.S. rank-and-file workers, according

to a study by the AFL-CIO, the largest U.S. federation of unions.

Many

CEOs at major companies have pay packages worth $10 million or more.

One

poll participant, Fargo, North Dakota cabdriver Brent Hartz, said CEO pay

is often "ridiculous" and worries that managers of funds he owns - such as

the $50 billion Vanguard Growth Index Fund (VIGRX.O)

- are too cozy with corporate chiefs.

"It's

almost like they're in cahoots with each other," Hartz said in a telephone

interview.

Asset

managers hold about 30 percent of U.S. corporate stock, giving them great

influence over executive compensation and other corporate governance

issues. Retail investors have about 89 percent of the nearly $16 trillion

held in mutual funds, according to trade group Investment Company

Institute.

All of

the five large firms - BlackRock Inc (BLK.N),

Vanguard Group, Fidelity Investments, State Street Corp (STT.N)

and T. Rowe Price (TROW.O)

- emphasize that executive pay should be linked to company financial

performance. Their voting history, however, shows that they rarely use

their ballots to challenge compensation packages for perceived

underperformance.

Last

year, the firms cast their advisory "say on pay" votes in support of

senior executives 96 percent of the time or more at S&P 500 firms,

according to research firm Proxy Insight.

That

level of support was typical for recent years, as median pay among S&P 500

CEOs rose to $11.3 million in 2014 from $9.4 million in 2010, according to

pay consultant Farient Advisors.

Big

fund firms are facing more questions about their pay votes. BlackRock

faces a shareholder proposal that calls for the world's largest asset

manager to report on how it might bring its voting practices in line with

its stated support of linking pay and performance. BlackRock calls such a

report unnecessary.

BlackRock spokesman Ed Sweeney said the firm believes that talking

privately with company officials is the best way to address pay issues.

Last year, the firm engaged with about 700 U.S. companies and focused on

executive compensation matters in 45 percent of those meetings, he said.

Vanguard spokeswoman Linda Wolohan said via email that executive pay “is a

matter on which people have a wide variety of views (as supported by your

survey results).” Pay is just one factor Vanguard considers in its proxy

voting and it often addresses pay issues with company boards privately,

she said.

Fidelity spokesman Charlie Keller said that its funds “are managed with

one overriding goal: To provide the greatest possible return.”

Spokespeople for T. Rowe Price and State Street declined to comment.

Publicly-traded U.S. companies were required to submit the pay of their

top executives for advisory votes by their investors under the 2010

Dodd-Frank financial reform act. With thousands of votes to cast each year

through electronic platforms, the companies each have their own governance

specialists to oversee their voting decisions.

Retired Massachusetts congressman Barney Frank, one of the act’s creators,

has suggested that funds with highly paid executives make poor overseers

of CEO pay.

BlackRock CEO Laurence Fink, for instance, made $25.8 million last year.

Several leaders of union and state pension funds, which vote against

executive pay more often, said the Reuters/Ipsos poll results suggest that

most investors want funds to take a harder line.

"Ultimately, it has got to be driven by their clients," said Mike

McCauley, a governance officer for the Florida State Board of

Administration, which manages $178 billion.

INEQUALITY DEBATE

Many

respondents supported the status quo. Thirty percent said S&P 500 CEOs are

paid “about right” and 21 percent said the fund firms “are taking the

correct approach” on pay.

In

Byron Center, Michigan, retired Army officer Gabe Hudson worries that the

government might step in to regulate executive pay.

"If

you think the CEOs are getting paid too much, you can always pull your

money out of the fund and go to another fund," Hudson said in an

interview.

The

poll did not ask about societal issues of income inequity, but many

respondents brought it up in interviews. Some also acknowledged they don't

carefully monitor proxy votes.

Barbara Dixon, a retired school teacher who lives in South Carolina, said

she has not closely followed such votes at the $15 billion Fidelity

Magellan Fund (FMAGX.O)

where some of her money is invested.

Still,

she wants the fund to play a role controlling in executive pay. "Someone

who is making millions of dollars does not need all that money," she said.

(Reporting by Ross Kerber; Editing by Carmel Crimmins and Brian Thevenot)

|

News

and Media Division of

Thomson Reuters

© 2016

Reuters All Rights Reserved |

|