|

THE

WALL STREET JOURNAL.

Business

Boeing’s Buyback Spending Makes Some Analysts Jittery

Plane maker’s plans raises concerns about cash flow for future

buybacks and R&D

|

Boeing, the world’s largest plane

maker, ended the first quarter with $7.9 billion in cash.

PHOTO: DAVID RYDER/BLOOMBERG NEWS |

By

Jon Ostrower

May 10, 2016 6:41 p.m. ET

Boeing

Co., the world’s biggest plane maker by deliveries, has spent $19

billion buying back its own stock over the past three years, a

spending spree that worries analysts who think the airplane-building

cycle may be near its peak.

The plane maker has been

directing almost all of its free cash back to shareholders, boosting

buybacks and dividends with the proceeds from record deliveries of its

passenger jets.

While many investors like

having excess cash

returned via buybacks, some

Boeing analysts worry the company is unwisely borrowing from the

future. The worry is what will happen to cash flow if sales fall from

their current very high levels.

Some analysts and

investors watching Boeing’s plans are jittery about the path for cash

flows to keep rising through the end of the decade to pay for buybacks

and research and development.

“The upward trajectory on

cash runs out next year,” said Robert Stallard, managing director at

RBC Capital Markets. He said Boeing should be preserving its cash,

citing a coming cut in the production of its profitable 777 jet and

the billions of dollars Boeing and rival

Airbus Group SE

spent to right their recent jetliner

programs.

A Boeing spokesman said

that “the strong core operating performance across our business

continues to generate significant cash flow and financial strength.”

He said that strength, combined with a healthy growth outlook,

provides the company with a foundation to continue its balanced cash

deployment strategy where it can invest in “innovative products,

technology and delivering returns to shareholders.”

Boeing ended the first

quarter with $7.9 billion in cash and forecasts approximately $10

billion in operating cash flow in 2016, and signals it expects that to

climb through the remainder of the decade. It had revenue of $96.1

billion in 2015.

The company said both its

capital expenditures and research and development spending is up in

2016 and its production increases are plotted through the end of the

decade. It anticipates returning an additional $10.5 billion over the

next two years or so.

Boeing’s

plans to cut head count, increase

output and the production of a more profitable mix of planes can lead

to a bigger cash benefit, according to Cai von Rumohr, analyst at

Cowen & Co.

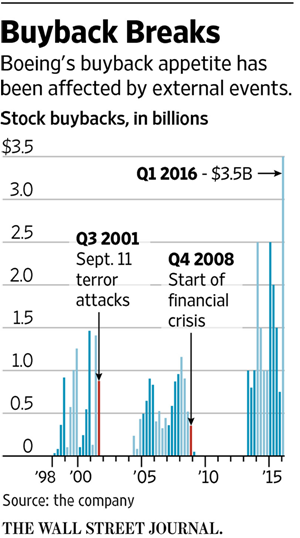

The plane maker moved its

buybacks into overdrive in the first quarter, spending a record $3.5

billion to repurchase 26.8 million shares.

Some investors and

analysts say that without a better place to invest free cash—such as a

big acquisition or new airplane project—and a slate of development

programs progressing smoothly, returning the cash to shareholders is

the best way to maintain an efficient balance sheet. Buybacks have

sharply increased among

many publicly traded companies,

reducing the number of available shares ultimately with the goal of

increasing the value of each share.

Boeing on Wednesday will

host its annual investor forum in Seattle to provide Wall Street with

insight into the company’s longer-term outlook, including its closely

watched cash flow.

Some analysts have also

pointed to how Boeing is adding to its overall cash pile. As its

factories pump out jetliners faster than ever, Boeing receives

progress payments during production from buyers to build their jets.

According to one leasing

company executive, Boeing during recent years has traded earlier cash

payments for concessions like improved pricing or making changes to

their orders.

Boeing has also asked its most stalwart

customers, and biggest buyers, for earlier payments.

United Continental Holdings Inc.

accelerated roughly $330 million to

Boeing during the fourth quarter of 2015, according to regulatory

filings.

Alaska Air Group Inc.

also said it had provided $72 million in

earlier advances to the plane maker in the fourth quarter of 2015.

Moving the payments

earlier “was a favor to one of our manufacturers and it does help us

out,” said Mark Eliasen, Alaska’s vice president of Finance and

Treasurer in January. A United spokesman said the advances are part of

“the normal course of business.”

A Boeing spokesman said

the timing of cash payments shifts from quarter to quarter and it

expects its advances to continue rising with output. “We partner with

our customers and suppliers to work through quarterly cash flow

volatility,” the spokesman said. “But it’s important to note these

actions go both ways.”

‘We partner with our

customers and suppliers to work through quarterly cash flow

volatility.’

—spokesman for Boeing

The plane maker is

confident it can book some cash early because its big order book will

keep the liquidity flowing.

Boeing Chief Executive

Dennis Muilenburg said last week that order cancellations and changes

were running far behind historical norms. Even if cancellations

spiked, said Mr. Muilenburg, “We’ve in fact designed our plans to

envelope those historical averages.”

The company is also

heading into a crucial period that could require significant research

and development spending, which could include moving ahead with plans

for an all-new jetliner to reverse market share losses to Airbus.

The advanced Dreamliner,

however, is Boeing’s ticket to a cash-rich future. Boeing has racked

up deferred costs of nearly $29 billion building more than 400 of its

787 Dreamliners. The company’s cash generation strategy is rooted in

recovering those costs, and then some.

To fill that hole, Boeing

projected at the end of the first quarter it would need an average

profit of $36 million on each of the next 662 planes it has on order.

The company says it won’t generate positive cash on each 787 delivery

until late this year.

Bank of America

forecasts a $14 billion shortfall, but

the company reiterates its plans are on track.

Write to

Jon Ostrower at

jon.ostrower@wsj.com

|