|

Walmart's $20

Billion Buyback May Be Bid to Forestall Potential Activists

Its $20 billion buyback

plan could signal trouble in paradise.

By

Cathaleen Chen

Oct 13,

2017 11:48 AM EDT

Wal-Mart

Stores Inc.'s (WMT)

$20 billion stock buyback program could be a bid to quiet dissent

among a group of increasingly restive institutional shareholders, even

though the massive family-owned retailer doesn't now face any known

activist threats.

Stock

buybacks, a standard practice for companies to boost the value of

existing shares and show they are in top shape, also serve as a

strategic tactic to appease shareholders, financial experts told

TheStreet. That could be the case for Walmart, which announced

the buyback as part of its earnings outlook report Tuesday, Oct. 10.

Keeping

institutional shareholders happy with buybacks could be seen as a

preemptive defense against any future issues, sources said.

"They're

obviously appeasing potential dissident shareholders," said Gary

Lutin, chairman of the Shareholder Forum, an online database for

corporate information. "The Walton family owns a large portion of

shares, but that doesn't mean the company is invulnerable to activist

threats."

By

increasing the stock price, Walmart's buyback program "keeps the

hedge-fund activists happy," said William Lazonick, an economics

professor at the University of Massachusetts who has penned extensive

articles arguing against buybacks.

The Waltons,

the founding family of the Arkansas-based retailer, own more than 50%

of the company. Walmart's other largest shareholders are institutions,

including the Vanguard Group Inc., which owns nearly 14% of shares and

SSgA Funds Managements Inc., with 3.5%. Given the Waltons' stake in

the company, it's not an attractive target for activist investors—that

is, unless long-term players invite them onto the board.

Walmart's

shareholder support rankings point to some unhappiness within the

company, Lutin told TheStreet. Vanguard and SSgA could not be reached

to comment for this story.

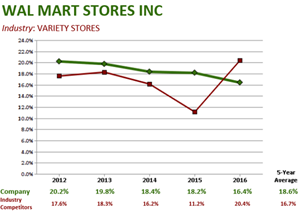

The support

ranking, or the percentage of shareholders that disapprove of

executives' pay, is relatively high at 16.7% in 2017, according to

Forum data compiled from the SEC. The percentage looks at total votes

cast in advisory "Say on Pay" shareholder approvals of executive

compensation.

Although

the vote is about compensation, the Say on Pay question can be viewed

a measure of shareholder approval, according to Josh Black, the

editor-in-chief of Activist Insight, a news and data provider on

corporate governance.

"It's

certainly a litmus test for dissent and happiness," he told TheStreet.

"They could disagree based on specific reasons, or vote in a way of

making a general statement about the company."

Walmart and activism?

|

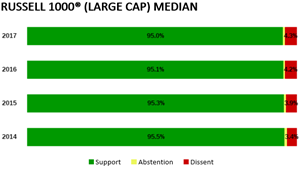

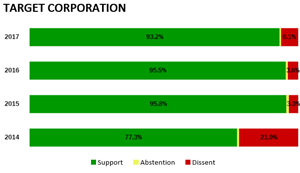

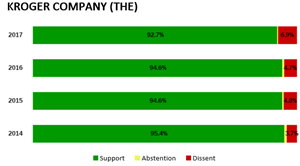

Walmart's

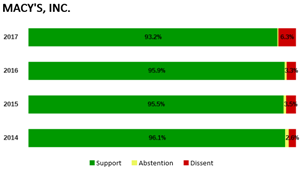

16.7% rating exceeds the average of 4.3% for the components of Russell

1000 and could signal disharmony among shareholders. Target

Corporation (TGT)

, for instance, saw a 6.1% dissent rate in 2017. Kroger Company (KR)

reported 6.9% and Macy's (M)

had 6.3%.

ProxyInsight, a database that tracks proxy reports, names BlackRock,

AXA Investment Managers, and ING as among Walmart's institutional

investors that voted no. The latter, for instance, said the reason for

its vote is Walmart's "non-rigorous goals."

"Both

annual and long-term incentives for fiscal 2017 performance were

earned above target against largely non-rigorous goals, despite the

fact that actual performance for a number of incentive measures

actually declined for the year in review," ING wrote as its rationale

for the June 2 vote, according to ProxyInsight.

But despite

the vote on executive compensation, Walmart's screen on activist

vulnerability is pretty low, Black told TheStreet.

Not

everyone is skeptical of Walmart's motives when it comes to its

buybacks. Brian Nagel, an Oppenheimer analyst, told TheStreet that the

buyback doesn't represent a strategic play as much as it is a

"reflection of confidence on the part of management."

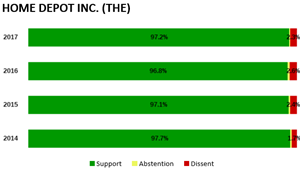

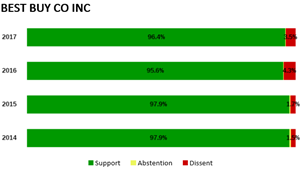

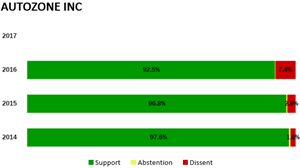

"As

retailers mature, despite the investments they make, they still

generate a lot of cash," he said. "Home Depot (HD)

, Best Buy (BBY)

, Auto Zone (AZO)

—they've all done it."

Walmart

itself claims the buybacks are nothing more than a way to invest in

its own business and earn a decent return for shareholders, according

to company spokesman Randy Hargrove.

"Because of

the strong cash flow we generate, it gives us the opportunity to buy

part of our company and shows the trust we have in our strategy and

that we feel comfortable about the company's value," he said in an

email statement Tuesday.

While

Walmart has never seen a proxy fight, shareholder disruption wouldn't

be new. The retailer faced some institutional challenges following a

bribery scandal that erupted in 2012, in which the New York Times

unveiled that the company not only paid more than $24 million in

bribes to obtain building permits throughout Mexico, but also buried

its internal investigation of the case. In 2014, the company disclosed

that it had paid $439 million over two years on investigations related

to possible violations of the Foreign Corrupt Practices Act in Mexico,

China, Brazil and India.

In the

fallout of the bribery scandal, its shareholder vote for the board of

directors reflected unprecedented dissent against top executives,

including then-CEO Mike Duke, with 13% of the 3.4 billion shares

voting against Duke's position on the board, the AP reported in June

2012. Then, in 2014, four shareholders including Amalgamated Bank's

LongView Funds and F&C Management Ltd waged a campaign for Walmart to

disclose how they've held accountable the executive involved in the

FCPA investigations.

Still,

Walmart has an extensive track record in repurchasing shares.

"In the

decade 2007-2016, Walmart did $67.3 billion in buybacks, equal to 45%

of profits, and another $51.2 billion in dividends, equal to 34% of

profits," Lazonick told TheStreet in an email, citing SEC data.

© 1996-2017 TheStreet,

Inc. |