THE

WALL STREET JOURNAL.

Markets

Insiders Pocket Gains on Buybacks, Vexing Regulator

SEC Commissioner

Jackson says executives are taking advantage of loopholes; calls

for review to change regulatory rules

|

The recent surge in buybacks

follows changes to the tax law that made them more attractive

for companies and executives have been selling significantly

more of their stock immediately after the news. Bloomin’ Brands

Inc., the operator of casual-dining spots including Outback

Steakhouse, illustrates the trend. PHOTO: SCOTT KEELER/ZUMA

PRESS |

By

Gretchen Morgenson and

Tom McGinty

June 10, 2018 12:00 p.m. ET

Corporate insiders

are personally capitalizing on the recent boom in buyback

announcements, vexing a top regulatory official.

Taking advantage of price bumps that often accompany

share-repurchase announcements, company executives have been selling

significantly more of their stock immediately after the news than they do

beforehand, according to an analysis by Robert J. Jackson, Jr., a commissioner

at the Securities and Exchange Commission.

In a speech on Monday, Mr. Jackson—appointed by President Donald

Trump and sworn in this year to fill a Democratic seat at the SEC—will urge

regulators to review securities laws that provide protection to insiders making

such trades.

Insiders who sell stock into buyout bounces aren’t trading

illegally, of course, and Mr. Jackson isn’t accusing them of that. And other

investors also have the opportunity to take advantage of the bumps. But these

price surges can be especially beneficial to corporate executives holding large

chunks of corporate stock looking for an uptick to unload shares.

“The SEC gives an exemption from market-manipulation rules to

companies doing a buyback,” Mr. Jackson said in an interview. “The SEC shouldn’t

be making it easier for executives to use them to cash out.”

Mr. Jackson, a former law professor, examined stock trades at 385

companies that announced buybacks in 2017 through this year’s first quarter. He

found the percentage of insiders selling shares more than doubled immediately

following their companies’ buyback announcements as many of the stocks popped.

Daily stock sales by the insiders rose from an average of

$100,000 before the buyback announcements to $500,000 after them. The sellers

received proceeds totaling $75 million more than had they sold before the

announcement, the study concluded. At 32% of the companies, at least one insider

sold in the first 10 days after the buyback announcement.

As is customary among SEC commissioners, Mr. Jackson is careful

to note that his views are his own and don’t reflect those of the entire agency.

The SEC didn’t return an email seeking comment.

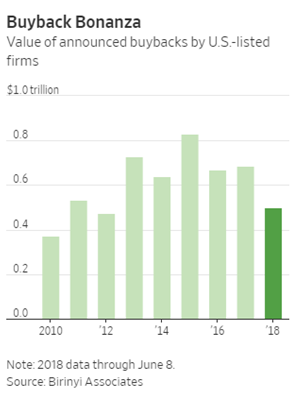

What’s clear is that such corporate share-repurchase programs

have grown increasingly popular among companies. So far this year, buyback

announcements from all U.S. publicly traded companies totaled just over $500

billion, according to data from Birinyi Associates Inc. For all of last year,

companies announced $685 billion in buybacks up from $670 billion in 2016.

The recent activity follows changes to the tax law that made

buybacks more attractive for companies. Many investors welcome the deals because

they often boost a stock’s price, but some consider them a dubious use of

corporate capital if they are made at high valuations or if the returns from

buybacks don’t exceed an investment in the business.

Stock repurchases can make a company’s earnings per share appear

better by reducing its number of shares outstanding. Buybacks can also bolster

executive pay at companies using benchmarks based on earnings-per-share

increases.

Mr. Jackson’s study didn’t identify specific companies. But

Bloomin’ Brands Inc., the operator

of casual-dining spots including Outback Steakhouse, illustrates the trend.

Before the market opened Feb. 22, the company announced its earnings and noted

the existence of a new $150 million stock-repurchase program.

On that day and on Feb. 26, Chief Technology Officer Donagh

Herlihy sold a combined 216,562 shares, generating roughly $1.4 million in net

proceeds, regulatory filings show.

On March 2, six days after the news, Chief Legal Officer Joseph

Kadow sold roughly 281,000 shares generating $5.07 million, according to the

filings. Also that day, Chairman and Chief Executive Officer Elizabeth Smith

sold 150,000 shares generating $2.5 million, filings indicate.

The sales were executed at prices that were, on average, 7%

higher than the closing price the day before the buyback was announced. The

three executives declined to comment on the sales but a Bloomin’ Brands

spokeswoman said in a statement: “We have had share buyback programs in place

continually since December 2014 and in similar or larger amounts.”

In the interview, Mr. Jackson said the SEC hasn’t looked at

buyback rules for more than a decade. With the recent surge in such activity, he

said, “it’s time to take another look at these rules.”

At issue is Rule 10b-18 of the Securities Exchange Act of

1934, which advises companies how to proceed with buyback timing and other

mechanics, such as prices paid and volume restrictions. It also provides a “safe

harbor” for officers or directors to trade in the shares during a repurchase

without running afoul of antifraud provisions of the securities laws.

Mr. Jackson believes that executives who sell into buybacks are

benefiting at the expense of shareholders. “If an executive believes a buyback

is the right thing for the long term, they should put their money where their

mouth is and keep their stockholdings,” he said.

The study also found that in the days leading up to share

repurchase announcements, the companies’ stocks underperformed the broader

market by an average of 1.4%. During the 30 days after the announcement, the

companies’ stocks outperformed the overall market by an average of 2.5%.

Mr. Jackson is scheduled to present his analysis Monday at the

Center for American Progress, a left-leaning think tank in Washington. The study

parallels his past academic work on corporate governance issues. He taught law

at NYU and Columbia and was founding director of the Columbia Law School’s Data

Lab, which used technology to study the reliability of company disclosures.

Write to

Gretchen

Morgenson at gretchen.morgenson@wsj.com and

Tom McGinty at tom.mcginty@wsj.com

Appeared in the June 11, 2018, print edition as 'Insiders Make Hay

On Rising Buybacks.'