On Governance: Stock Buybacks – A Recent Trend That

May Change Executive Compensation Pay Practices

|

|

On Governance is a series of guest blog posts from corporate

governance thought leaders. The series, which is curated by the

Governance Center research team, is meant to serve as a way to

spark discussion on some of the most important corporate

governance issues. |

|

|

On June 11, 2018, SEC Commissioner Robert Jackson highlighted the practice

of executives more likely to sell stock following a stock buyback.

Commissioner Jackson’ analysis shows that “twice as many companies have

insiders selling in the eight days after a buyback announcement as sell on

an ordinary day.” The implication is that executives take advantage of the

stock price bump-up to sell shares. His remedy is two-fold: (1) SEC will

review the safe harbor rules for insiders selling shares and (2) implore

boards and compensation committees to review this practice.

A stock buyback is when a company purchases its own stock, either on the

open market or directly from its shareholders. A buyback is also known as

a share buyback or stock repurchase. Similar to a dividend, a buyback is a

way to return capital to shareholders. While a dividend is effectively a

cash bonus amounting to a percentage of a shareholder's total stock value,

a stock buyback requires the shareholder to surrender stock to the company

to receive cash. Those shares are then pulled out of circulation and taken

off the market, thus having a similar effect of returning capital to

shareholders.

Buybacks are a relatively new concept. Prior to 1982, they were not

common. In fact, they were illegal throughout most of the 20th century

because Buybacks were considered a form of stock market manipulation. In

1982, the SEC passed Rule 10b-18, which created a legal process for

executing a buyback.

Today, in 2018, more companies than ever are buying back stock. The

increase in buybacks has been fueled by The Tax Cuts and Jobs Act passed

on December 27, 2017, which substantially lowered the corporate income tax

rate as well as repatriation tax that encouraged money held abroad to be

brought back to the United States.

There are three main types of buybacks: cash-based, loan-based and a

combination of cash and equity. The effect of a buyback on an executive

incentive program and pay levels will depend on a variety of factors and

is specific to each company and its unique incentive program. In general,

there are many positive aspects of buybacks, which center on increasing

stock price and thus shareholder value:

1.

Increase Shareholder Value:

Often, a company will use a buyback to pump up the price of its shares

when it believes they have become undervalued. The undervalued stock is

brought back at a lower price and is sometimes viewed as a signal by

investors that the stock will appreciate in value (even greater than the

percent brought back).

2.

Return Cash to Shareholders:

Buybacks are often used to provide current shareholders with a cash

distribution, and this is viewed as a bonus by many investors. Thus, an

investor can sell some of the stock held back either to the company or

into the open market, which is supported by the strong demand created by

the buyback.

3.

Provide Consistent Shareholder Returns:

Buybacks provide more consistent returns to shareholders vs. special cash

or stock dividends that only benefit the current shareholders. This allows

buybacks to complement dividend rates, boosting shareholder return without

having to increase a stable dividend rate.

4.

Reduce Aggregate Cash Dividends:

Buybacks provide a viable way for companies to reduce their cash outflow,

without actually having to cut their dividends. Fewer outstanding shares

mean fewer dividends to be paid, and a company may reduce their dividends

by a significant amount. The present value of the reduction in aggregate

cash dividends may be less than the cost of the buyback.

5.

Increase Earnings per Share (EPS):

Removing some shares from the marketplace means annual earnings will be

distributed among fewer shares, and each share will be entitled to a

greater portion of earnings. The reduction of shares is somewhat

counteracted by the interest earned on the cash used for the buyback.

6.

Boost Capital Efficiency Measures:

Buybacks can increase financial ratios used to calculate capital

efficiency measures such as Return on Equity (ROE), Return on Assets (ROA),

or Return on Invested Capital (ROIC). Capital structure plays a large role

in how companies optimize opportunities and provide cash for growth and

operations. A major factor of capital structure is the debt to equity

ratio. When a company initiates a buyback, it effectively changes its

capital structure, because fewer outstanding shares equates to less

outstanding equity. This change in structure has the benefit of increasing

a company’s capital efficiency measures, simply because its generated

returns are now linked to a lower level of equity, assets, and invested

capital.

7.

Increase Market Liquidity:

Sometimes a large shareholder or seller of a specific stock is looking to

liquefy their holdings, and the stock-issuing company may offer to buy

back their shares from them.

8.

Offset Dilution.

A buyback will offset dilution from issuance of shares as part of a

long-term incentive (LTI) program.

Despite these positive attributes, there has been much criticism

surrounding buybacks, particularly surrounding their potential to increase

executive compensation levels regardless of the operational success of the

company. This is particularly true with the recent reduction in corporate

income tax rates. The underlying business model has not really changed or

improved, but there is extra cash generated due to the tax savings.

Buybacks directly influence many of the financial ratios used as

performance metrics in executive LTI plans. As discussed previously,

Buybacks can boost EPS, ROE, ROA, ROIC, or stock price. While growth in

pay levels through the increased value of stock holdings and LTI payouts

may benefit executives, there is bound to be criticism from investors,

employees, and political factions.

A key connection between buybacks and executive pay is EPS. A buyback will

reduce the number of a company’s outstanding shares and thereby increase

the earnings per share metric. EPS is often a key benchmark for an

executive’s performance-based pay – particularly in LTI programs. In

addition to EPS, a buyback also impacts other parts of the financial

statement. On the balance sheet, a share repurchase will reduce the

company’s cash holdings, and consequently its total assets base, by the

amount of the cash expended in the buyback. The buyback will

simultaneously also shrink shareholders' equity on the liabilities side by

the same amount. As a result, performance metrics such as ROE ROA and ROIC

typically improves following a buyback. Like EPS, each of these capital

efficiency measures are commonly used in executive LTI plans.

Another issue when it comes to executive compensation is that a buyback

generally occurs during an LTI award’s performance period, and there is no

corresponding adjustment to the performance goals to offset the effect of

the Buyback. So, it can be said that a Buyback gives the executives a head

start in achieving their performance goals.

At a time when institutional investors frequently challenge whether

performance targets are rigorous enough, critics of buybacks believe

senior executives should not receive larger pay packages simply for

reducing the number of shares outstanding. There is also concern that

while buybacks they may boost stock prices in the short term, they can

deprive companies of capital necessary for creating long-term growth.

A Closer Look at Buybacks and Executive Pay

It is indeed true that executives in the United States will receive larger

incentive payouts when measures like EPS, ROE, ROA, ROIC, and stock price

show improvement (financially engineered or not).

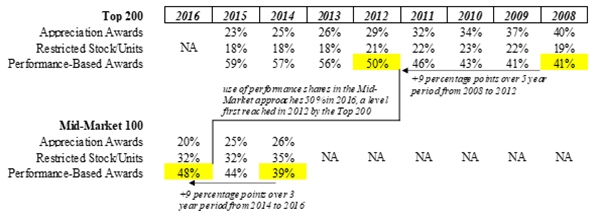

Today’s executive pay packages 1) include a significant portion of LTI

awards, and 2) rely heavily on LTI awards with performance conditions

(versus time-based awards). A recent Gallagher study[1]

showed that a majority of executive LTI awards at large-cap companies are

tied to performance measures, including stock-price- or EPS-related

measures. Among the Top-200 companies by market capitalization,

performance-based LTI awards first averaged 50 percent of the total LTI

grant value back in 2012. By 2015, performance-based awards had increased

to 59 percent of the total LTI grant value.

Following closely behind top companies, we found that midmarket companies

have also moved towards LTI programs focused on performance-based awards[2].

In 2016, performance-based awards made up 48 percent of the total LTI

grant value among these companies, up from just 39 percent in 2014. This

midmarket sample includes 100 companies selected at random from the

Russell 3000 universe and included companies across multiple industry

sectors with revenues between $1 billion and $5 billion (nonfinancial

companies) or assets between $1 billion and $10 billion (financial

companies). See Figure 2.

FIGURE 2. Mid-Market Companies Follow the Large Company Trend of Relying

on Performance-Based LTI Awards

Conclusion

Boards of directors continually search for ways to increase shareholder

value. This process will sometimes result in a decision to buy back

company stock. Care should be taken to avoid enrichment of executive pay

packages as a result of the buyback. The selection of performance measures

and corresponding performance levels can be one of the most difficult

aspects of designing an incentive compensation program for executives.

Scrutiny may be further complicated as buybacks continue to increase in

prevalence. Companies should be cautious when selecting performance

measures that can be manipulated by financial engineering such as

buybacks, equity to debt swaps and other re-financings, and be ready to

explain the reasoning behind such choices in the annual proxy statement.

The views presented on the Governance Center Blog are not the official

views of The Conference Board or the Governance Center and are not

necessarily endorsed by all members, sponsors, advisors, contributors,

staff members, or others associated with The Conference Board or the

Governance Center.

The

views presented on the Governance Center Blog are not the official views

of The Conference Board or the Governance Center and are not necessarily

endorsed by all members, sponsors, advisors, contributors, staff members,

or others associated with The Conference Board or the Governance Center.

[1]

Gallagher’s 2015 Study of Short- and Long-Term Incentive Design Criteria

Among Top 200 Companies (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2916206)

[2]

Current Trends in 'Mid-Market' Incentive Plan Design (https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3152287)

|

About the Author: James F.

Reda

Managing Director,

Executive Compensation

Arthur J. Gallagher & Co Human Resources & Compensation Consulting

Practice

|

|

Jim works with both public and private organizations in planning,

creating, and implementing incentive programs. Jim also advises

companies on incentive strategy, including long- and short-term

senior executive employment arrangements, change-in-control

metrics, business combinations, shareholder rights, and corporate

governance issues. He is a recognized expert in the area of

integrating incentive and corporate strategies.

Jim has more than 27 years of experience specifically in the area

of senior executive compensation. Prior to forming his own firm in

2004 (which was acquired by Arthur J. Gallagher & Co. in 2011),

Jim worked at three major executive compensation consulting firms.

He began his executive compensation consulting career at The

Bachelder Group in 1987, where he worked for nine years.

More from James F. Reda

|

|

| ©

2018 The Conference Board Inc. |

|