Deep Dive

Micron’s stock might be an excellent play for AI investors who want to

diversify beyond Nvidia

Last

Updated: Sept. 22, 2023 at 8:07 a.m. ET

First Published: Sept. 21, 2023 at 12:39

p.m. ET

—

By Philip

van Doorn

High prices for Nvidia’s GPUs may be

unsustainable. Meanwhile, Micron’s new high-bandwidth memory chips

could offer stickier pricing and propel its recovery.

|

MARKETWATCH PHOTO ILLUSTRATION/ISTOCKPHOTO

|

Investors have shown their enthusiasm for artificial intelligence this

year by sending shares of Nvidia Corp. on a rocket ride. But there are

other hardware companies selling products that are used by data

centers every time an Nvidia graphics processing unit is installed.

And the rollout of new high-bandwidth memory technology next year

could provide a boost for Micron Technology Inc. This could be an easy

way for U.S. investors to take a more diversified approach to AI.

Nvidia’s stock NVDA has

returned 189% this year, with dividends reinvested. The stock has been

propelled by the ramping up of production and sales for the company’s

H100 GPU, which was initially shipped during the third quarter of

Nvidia’s fiscal 2023, which ended Oct. 30.

H100 sales ramped up during the first quarter of Nvidia’s fiscal 2024,

which ended April 30. When Nvidia announced its results for that

quarter on May 25, investors were shocked when the company said it

expected sales for its fiscal second quarter to come in at about $11

billion, which would be a 53% increase from the fiscal first quarter.

On Aug. 23, when Nvidia announced results for the second quarter of

its fiscal 2024, which ended July 30, investors were surprised

again, as quarterly sales came in at $13.51 billion. This

was an 88% sequential increase and an increase of 101% from the

year-earlier quarter.

Now let’s turn to Micron MU and

how it can further benefit from AI technology. Nvidia said in its Aug.

23 press release that it would begin shipping its new GH200

Grace Hopper Superchip during the current quarter, “with a

second-generation version with HBM3e memory expected to ship in [the

second quarter] of calendar 2024.”

HBM stands for high-bandwidth memory. The current generation of the

technology is HBM3, for which SK Hynix Inc. and Samsung Electronics

Co. have roughly a 50/50 split, according to Pat Srinivas, an analyst

with the Buffalo International Fund BUIIX. Both companies are based in

South Korea.

During an interview, Srinivas described current AI technology as

“drinking from a fire hose” because of the large amounts of data

required for training and inference by AI systems. HBM is needed in

order to provide as much memory as possible while using the least

amount of electricity.

“Micron is not playing at all” in the first-generation HBM3 market,

Srinivas said. But the company expects to roll out a next-generation

HBM3 product early next year. Micron is based in Boise, Idaho, and its

shares are listed on the Nasdaq.

During Micron’s earnings call on June 28, CEO Sanjay Mehrota said he

expected “meaningful revenues” from the new product during the

company’s fiscal 2024, which began Sept. 3, according to a transcript

provided by FactSet. Mehrota went on to say that some of Micron’s

customers had begun sampling its new HBM3 product and that the

response had been strong.

During the post-earnings call with analysts on June 28, Micron Chief

Business Officer Sumit Sadana said the company’s coming

next-generation HBM3 chips were “head and shoulders above current HBM3

products in the market in terms of performance, bandwidth, power

consumption.”

During the same call, Sadana discussed a “special partnership” with

Nvidia to develop a low-power memory product for use with the Nvidia

GH200. So there is another potential catalyst for Micron as the AI GPU

market moves quickly.

The next-generation HBM3 products on tap for next year are called

“HBM3e” by Nvidia and by TrendForce, which published its projections for

the 2024 rollout by Micron, SK Hynix and Samsung on Aug. 1.

Srinivas cited an Aug. 17 report by HPC

Wire for an estimated average cost of $30,000 for Nvidia’s

“flagship H100 GPU (14,592 CUDA cores, 80GB of HBM3 capacity,

5,120-bit memory bus),” and also private research for an estimated

cost of $1,200 to $1,380 for HBM needed for each H100 GPU

installation, “which roughly translates to 4-5% of the total cost.”

The analyst cautioned that it is the nature of the semiconductor

industry for technology to change quickly. He also said that even if

Micron were to take a 25% share of the total HDM market, “this would

only be about 10% of their estimated $20 billion revenue.” That

last figure is close to the consensus estimate of $20.3 billion in

revenue for Micron’s fiscal 2024. But below we will switch to calendar

years for easier comparisons of estimates.

Micron’s view of a potential market share of 25% for HBM was cited by

Mizuho Securities analyst Vijay Rakesh in a note to clients on Aug.

31.

The stocks

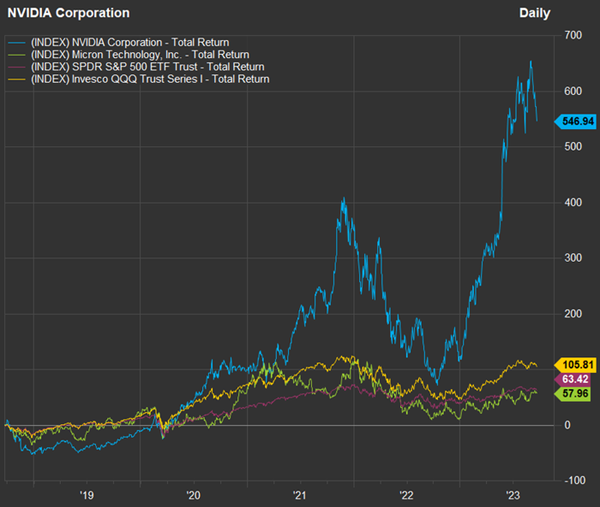

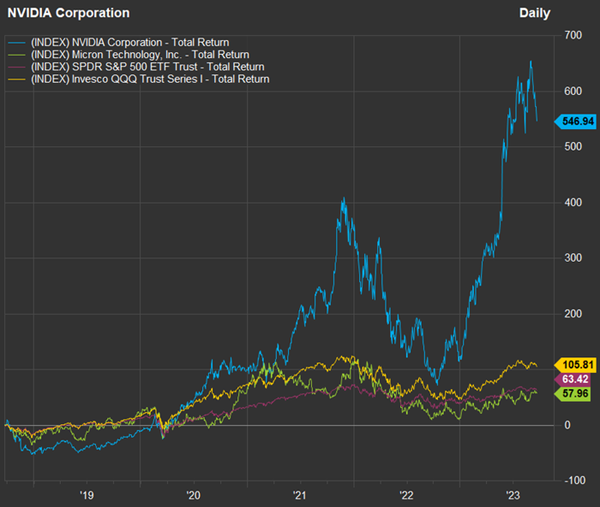

Here’s a chart showing five-year total returns for shares of Nvidia

and Micron, along with the SPDR S&P 500 ETF Trust SPY and

the Invesco QQQ Trust QQQ, which

tracks the Nasdaq-100 Index, which includes both Nvidia and Micron:

FACTSET |

Looking back, it is obvious that Nvidia has been the runaway winner.

But investors need to look ahead. The chart also shows how volatile

the semiconductor industry can be. For Nvidia, there was a

closing-price peak-to-trough decline of 66% from Nov. 29, 2021,

through Oct. 14 of last year, for an extreme example.

Getting back to total returns with dividends reinvested, here’s a

summary for certain periods:

|

Company

|

Ticker

|

2023 return

|

2022 return

|

Return since the end of 2021

|

|

Nvidia Corp.

|

NVDA

|

189%

|

-50%

|

44%

|

|

Micron Technology Inc.

|

MU

|

40%

|

-46%

|

-24%

|

|

SPDR S&P 500 ETF Trust

|

SPY

|

16%

|

-18%

|

-5%

|

|

Invesco QQQ Trust Series I

|

QQQ

|

37%

|

-33%

|

-7%

|

|

Source: FactSet

|

Nvidia has more than made up for its 2022 decline, but Micron’s stock

is still down significantly from the end of 2021.

A direct comparison may not be very useful to investors, as Nvidia is

on the cutting edge of AI GPU design and implementation, while Micron,

as a manufacturer of computer memory chips, often plays in a commodity

space. Then again, Micron appears to be ready for an upswing.

Deutsche Bank analyst Sidney Ho upgraded

Micron to a buy rating from a hold rating on Monday, saying

the worst was over for a supply glut for DRAM and NAND memory chips.

Here’s a look at calendar-year revenue figures, in millions of

dollars, for 2019 through 2022 for Nvidia and Micron, with consensus

estimates among analysts polled by FactSet for 2023 and 2024:

|

Company

|

Ticker

|

2019 sales

|

2020 sales

|

2021 sales

|

2022 sales

|

Est. 2023 sales

|

Est. 2024 sales

|

|

Nvidia Corp.

|

NVDA

|

$10,618

|

$16,042

|

$26,034

|

$27,505

|

$51,794

|

$77,970

|

|

Micron Technology Inc.

|

MU

|

$20,291

|

$22,544

|

$30,136

|

$25,792

|

$17,053

|

$23,212

|

|

Source: FactSet

|

Srinivas explained that Micron benefited from a spike in demand

because of the work-from-home trend during the pandemic in 2021, with

a concurrent disruption in supply. This led to excess inventory that

then led to the accelerating sales decline into 2023.

Now let’s look at calendar-year earnings per share and estimates:

|

Company

|

Ticker

|

2019 EPS

|

2020 EPS

|

2021 EPS

|

2022 EPS

|

Est. 2023 EPS

|

Est. 2024 EPS

|

|

Nvidia Corp.

|

NVDA

|

$1.08

|

$1.66

|

$3.64

|

$1.94

|

$10.01

|

$16.13

|

|

Micron Technology Inc.

|

MU

|

$2.73

|

$2.71

|

$6.97

|

$4.14

|

-$3.31

|

$1.34

|

|

Source: FactSet

|

The analysts working for brokerage firms polled by FactSet expect

relatively modest earnings for Micron as sales increase 36% from their

depressed 2023 level. The analysts expect Nvidia’s profit to rise by

more than 60% next year, with another 51% increase in sales to follow

this year’s expected 88% increase in sales.

For standard stock valuations, let us move to calendar 2024 rather

than using the customary 12-month estimates, because Micron’s 12-month

EPS estimate is negative.

-

Nvidia’s shares closed at $422.39 on Wednesday and traded for 26.2

times the consensus 2024 EPS estimate and 13.4 times the consensus

2024 sales-per-share estimate of $31.57.

-

Micron’s shares closed Wednesday at $69.68 and traded for 51.8

times the consensus 2024 EPS estimate and 3.3 times the consensus

2024 sales-per-share estimate of $21.19.

-

In comparison, the S&P 500 SPX trades

for 17.9 times its weighted 2024 EPS estimate and 2.3 times its

weighted 2024 sales-per-share estimate. Based on the weighted

estimates, analysts expect the S&P 500’s EPS to increase 12% in

2024, with sales per share increasing 5%.

Micron is much less expensive than Nvidia on a projected

price-to-sales basis. It is also notable that Nvidia’s high

price-to-sales estimate is close to its price-to-earnings estimate.

This underscores how profitable Nvidia is.

The following is from the Aug. 17 HPC

Wire report: “Barron’s senior writer Tae

Kim in a recent

social-media post estimates it costs Nvidia $3,320 to make

a H100. That is a 1000% percent profit based on the retail cost

of an Nvidia H100 card.”

That profit margin is based on HPC wire’s $30,000 average price

estimate for Nvidia’s H100.

How sustainable is that profit margin likely to be? Such a lucrative

margin is bound to attract new competitors eventually, even beyond

Advanced Micro Devices Inc. AMD, which

is expected by Moody’s analyst Raj Joshi to

ship large amounts of “its new high-volume accelerators”

during the first quarter of 2024.

Among 37 analysts polled by FactSet, 28 — or 76% — rate Micron’s stock

a buy or the equivalent. Their consensus price target is $79.90, which

is 15% higher than the closing share price on Wednesday. But that is

only a 12-month price target. One year may be a short period for a

long-term investor considering Micron, which is expected to begin

recovering from two years of brutal sales declines in the wake of the

pandemic disruption.

In his Aug. 31 note, Mizuho Securities analyst Vijay Rakesh wrote that

with the HBM market expected to double in 2024, driven by the adoption

of AI, “there is currently not enough HBM supply to meet the

[estimated] demand, leading to better margins/pricing in HBM vs. other

areas of the memory market, which should be a 2024E tailwind for

[Micron].”

Srinivas was unable to give a direct opinion about the current

valuation of Micron’s stock but said the company has momentum “on a

qualitative basis.”

Micron did not respond to a request for comment.

About the Author

|

Philip van Doorn

Philip van Doorn writes the Deep Dive investing

column for MarketWatch. |

|

Copyright ©2023 MarketWatch, Inc.

|