Norfolk Southern is getting back on

track–but activist investor Ancora is trying to derail it in a vicious proxy

fight

BY

JEFFREY SONNENFELD

AND

STEVEN TIAN

April 15, 2024 at 1:09 PM EDT

|

Alan Shaw, the president and CEO of

Norfolk Southern Corporation, testifies before the Senate Environment and

Public Works Committee in the wake of the Norfolk Southern train

derailment and chemical release in East Palestine, Ohio in 2023.

ANNA MONEYMAKER - GETTY IMAGES

|

The classic Edison Studios 1903 silent film “The Great Train Robbery”,

one of the first commercial successes in movie history, staged a

fictional heist on railroad tracks belonging to what is now Norfolk

Southern. Over a century later, that same railroad, Norfolk

Southern, risks being the scene of a genuine great train robbery.

This time, the assailants are being played by a struggling activist

investor, Ancora, apparently looking to profiteer from a recent tragic

accident clouding over the impressive crisis management of the

railroad’s leadership and wildly flinging charges against Norfolk

Southern to see what sticks. But in reality, Ancora is dramatically

misconstruing Norfolk Southern’s trajectory of dramatic documented

improvements over the last year, across safety, efficiency, and

profitability–and the choice between Norfolk Southern’s proven

strategy and Ancora’s activist challenge

could not be more stark, as we show in our comprehensive

original analysis found here.

Norfolk Southern’s safety improvements

Ancora initially launched its activist

campaign against Norfolk by excoriating

Norfolk Southern’s response to

the East Palestine tragedy, which has loomed large over Norfolk

Southern over the last year and almost needs no amplification at this

point. On Feb. 3, 2023, merely months after he started as CEO, Norfolk

Southern’s Alan Shaw was confronted with one of the worst railroad

disasters in recent history: a 151-car freight train derailed in

the village of East Palestine, Ohio, leading to the release of

hazardous chemicals and a temporary evacuation of the entire area.

Mercifully, there were no deaths or injuries but a national

outcry over rail safety ensued.

However, Ancora’s attacks over how Shaw handled East Palestine landed

with a thud, since it was hardly supported by any factual evidence nor

the lived experience of those involved in the East Palestine tragedy,

making it look like a rather naked attempt to profiteer by exploiting

the community’s suffering.

Top East Palestine community leaders have

expressed their appreciation that Shaw and his team followed the model

of successful corporate crisis management responses. Rather than

dispatching PR firms or midlevel deputies, or hiding behind

smokescreen statements of corporate legalese, Shaw and his top

deputies decamped

to East Palestine themselves,

and forged genuine

personal relationships with

local leaders and residents. Aided by hundreds of their own employees

on the ground, they established clean-up partnerships with municipal,

state, and federal officials focusing on environmental rehabilitation,

economic development projects, remuneration to homeowners and

businesses, and personal counseling. Over the last year, Norfolk

Southern has invested well over $700 million dollars into the local

community, showing good-faith execution of company promises.

Ancora’s attacks on overall rail safety similarly missed their mark.

There is no doubt that Norfolk Southern has had historical challenges

with safety, but Shaw

has led the company

in completely transforming its internal safety processes and

practices, not only by increasing staffing on railcars and fostering a

stronger safety culture within the workforce but also through

next-generation safety innovations such as integrating AI and

automation into train inspections and piloting new hot bearing

detectors.

|

The data clearly shows that Shaw’s safety

improvements are working. As we

show here in our comprehensive original analysis,

according to datasets from the Federal Railroad Administration, in

2023, compared to U.S. Class I railroad peers, Norfolk Southern was the

single safest railroad in the nation with

the lowest total number of mainline accidents, and the greatest

percentage drop in accidents from the year before. So far in 2024,

Norfolk Southern has sustained that progress

as the single safest railroad.

No wonder that Ancora’s unwarranted

mudslinging over safety catalyzed

an unprecedented array of

regulators, labor leaders, local officials, and NS employees to rush

to Shaw’s defense. The mayor of East Palestine, Trent Conaway, argued,

“Norfolk Southern has taken responsibility…and helped the village.

They are contributing to the village. They’ve been good partners.”

Amit Bose, the administrator of the Federal

Railroad Administration,

declared that “any

backsliding as a result of a change in leadership…on the

safety-oriented path Norfolk Southern has laid out and communicated

with us will…attract renewed oversight attention from my office as we

pursue our safety mission.”

Bose was joined by his counterpart, the

powerful chairman of the Surface Transportation Board, Marty Oberman,

who was

unambiguous about whose side he

stood on: “For Ancora to condemn the management of Norfolk Southern,

it shows a lack of understanding about moving freight around the

country.” An influential union leader, Scott Bunten, was even more

pithy: “Ancora’s plan will

decimate the railroad all over again.”

Efficiency and productivity turnarounds under Alan Shaw

After running up against such a strong show

of support for Norfolk Southern’s improved safety track record, the

activist then latched

onto productivity and efficiency

as key areas for improvement,

disingenuously promising that if

the activist slate won, they would bring Norfolk Southern’s operating

ratio (OR) down well below 60% within 13-14 months–a wildly

unrealistic proposition. The reality is that as Chairman of the

Surface Transportation Board Marty Oberman

pointed out, “the rapid

reduction in OR championed by Ancora can only be accomplished by major

new reductions in the workforce.”

Firings of that magnitude are not likely to

pass muster with Biden Administration regulators, so perhaps it is no

wonder Ancora has refused

to meet with Oberman despite his

direct regulatory/supervisory role over the nation’s rail systems. It

is hard to imagine how Ancora can build a productive relationship with

regulators whom they have

alienated so dramatically

through their disingenuous false promises.

But even setting aside Ancora’s wildly

unrealistic targets, there is no question that investors are seeking

improved efficiency and productivity at Norfolk Southern, and management

is now freshly focused on delivering with aplomb.

Over the past year, Norfolk Southern’s average train velocity has

increased by 25%, and continued

acceleration will produce $550 million in

total velocity-related savings over the next three years. Increased

velocity not only amounts to a less expensive, more reliable railroad

but also higher quality service with more volume and pricing power as

goods get picked up and delivered on time.

|

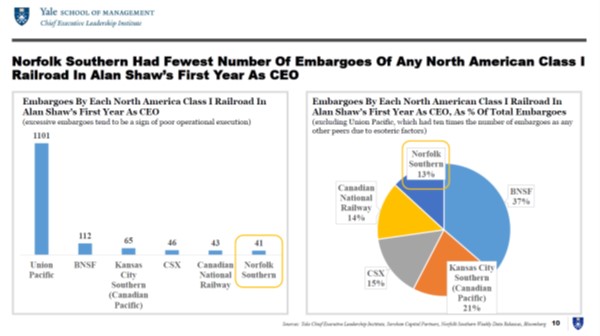

Norfolk Southern has also reduced

average dwell time by 33% over the last year,

reducing needless waits and costly overtime. It speaks to Norfolk

Southern’s underappreciated operational prowess that the company had

the fewest number of embargoes of any North American Class I railroad

in Alan Shaw’s first year as CEO–but management is continuing to drive

further efficiency and productivity improvements

and is en route to bringing

OR down below 60% by 2026,

a far more realistic target than the activist’s. All this is a

testament to Norfolk Southern’s focus on improving efficiency but not

running afoul of regulators in doing so, unlike Ancora’s

slash-and-burn approach.

A golden age for railroad growth

Some financial

analysts and commentators are inclined

to view Ancora’s activist

challenge to Norfolk Southern as another railroad

basket case where activists can

and should shake

things up, even beyond

any specific concerns over

safety, efficiency, or productivity. After all, to some investors, the

entire railroad industry is renowned for bloat, with its duopoly

structure and impenetrable moat entrenching complacency.

As activist investor and CNBC commentator Kenneth

Squire quipped, “Inside the

activist world, [going after a railroad] is as sure of an activist

strategy as there is,” pointing out there have been no less than four

prominent cases over the last decade where activists successfully

replaced a rail CEO. And in all four cases, activist involvement

significantly improved the subsequent financial and operational

performance of those railroads. Further helping Ancora is the

ostensible stature of several of their board candidates, including the

well-regarded former UPS COO Jim Barber as well as the virtuous former

Ohio Governor John Kasich, with Ancora boosters even suggesting that

their activist slate could

emerge as the next Hunter

Harrison.

But what these boosters miss is that times

have changed in the railroad industry, and there will never be another

Hunter Harrison. Harrison, a legend in the rail industry, was

renowned for inventing precision scheduled railroading (

PSR), which improved efficiency at the cost of slashing workforces,

reducing maintenance budgets, and taking shortcuts, often to the

frustration of customers and regulators. Harrison, and his vision of

PSR, was a product of a specific time and place. Today, a stricter

regulatory climate and changing political winds make that approach increasingly

unfeasible, as even Harrison

himself began

to acknowledge towards the end

of his life.

Alan Shaw is not and will never be Hunter

Harrison, but what Alan Shaw is doing now makes him the right leader

at the right time. Shaw is pioneering a radically different approach.

He and his new

COO John Orr call it “PSR 2.0”.

It builds on the best of PSR 1.0 in driving efficiency and

productivity while making up for what PSR 1.0 sacrificed: quality of

service and customer satisfaction. As Orr

puts it, “It means taking a

broader view on what you’re trying to achieve. It’s not just a myopic

slash-and-burn perspective on reducing costs and expenses. It’s having

a responsibly managed operating plan that’s reliable and repeatable

and underpinned by the value of safety. That creates growth

opportunities because you’re able to then respond to emerging growth

opportunities in the marketplace.”

And there is certainly no shortage of

emerging growth opportunities for the railroads to capture. Some rail

experts, such as Eric Mandelblatt of Soroban Capital, are calling this

the “golden

age for railroading growth,” the

result of a unique, once-in-generation confluence of secular

tailwinds, as we examine more in-depth in our comprehensive

slide deck here.

Most important and transformative of all,

North American railroads have a

once-in-a-generation opportunity to

benefit from reshoring, friend-shoring, and the resurgence in North

American manufacturing. Thanks in part to large-scale fiscal stimulus

such as the $1.2 trillion Infrastructure and Jobs Act, the $738

billion Inflation Reduction Act, and the $280 billion CHIPS Act,

domestic industrial manufacturing will continue

to surge for years to come, with

the U.S. Census Bureau already

reporting a near-tripling in monthly U.S. construction spending on

manufacturing over the last

three years. Railroads are prime

beneficiaries of higher spending

on industrial manufacturing, due to the large scale and heavy nature

of difficult-to-transport materials.

Furthermore, manufacturers will continue

to re-shore

supply chains to North America

from Asia amidst rising geopolitical tensions, and the magnitude of

this re-shoring is already captured

in trade data:

Whereas China was America’s largest trade partner by far merely five

years ago, doing

30% more trade than the U.S. did

with either Mexico or Canada, China has now fallen to third place with

both of Mexico and Canada each

doing nearly 30% more trade than

the U.S. does with China.

Another secular tailwind is the growth

in U.S. commodity production volumes. The U.S. has become

the world’s energy superpower as the

leading producer of oil, producing more

oil than any country in history and nearly 50% more than

each of the runner-ups, Saudi Arabia and Russia. The U.S. has also

become a

leading producer of natural gas, copper, lithium, and other

commodities, including several which are vital to the EV and electric

battery supply chain.

The bulk commodities and the heavy materials required to produce

commodities require

rail transportation, so rising commodities production

domestically is directly levered to rising rail volumes. Furthermore,

though some fear the declining use of coal in North America will hurt

rail revenues, global demand

for coal continues to surge year after year, especially for

metallurgical coal, which is vital and irreplaceable in the

steelmaking process. Even North American thermal coal producers are

finding healthy global demand for their product on the global export market,

so coal will likely remain a significant driver of rail revenues for

decades to come.

As these tailwinds, as well as the

rise of e-commerce, drive increased freight and transport

needs across the supply chain, railroads have a unique opportunity to

recapture lost market share from their primary competitors, trucks. As

Alan Shaw recently

pointed out, “Over the last 20 years, rail has ceded share

to truck. Truck volumes are up about 30%, while rail volumes are down

about 30%. There’s only one reason, and that’s because rail has not

been able to compete based on service. The rail industry goes through

a service meltdown, and that causes customers over time to ship

business that should be on rail over to truck.”

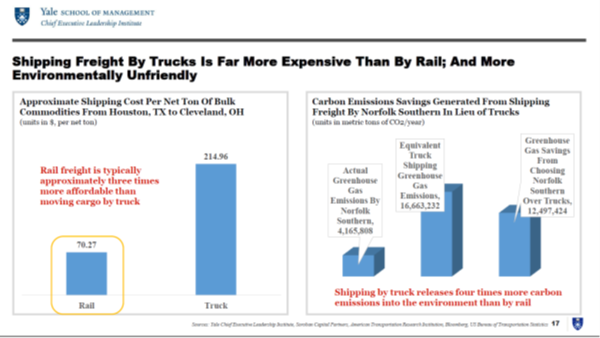

At least on paper, rail should have every

advantage over trucks amidst increased freight demands. Shipping by

truck is not only three

to four times more expensive than

by rail–but truckers are also far

more vulnerable than railroads to rising

labor and fuel cost inflation since

trucks require far more workers than rail to carry smaller amounts of

freight per trip. Railroads are also key in the fight against climate

change, since shipping by truck releases

four times more carbon emissions into

the environment than by rail.

The opportunity for railroads to recapture

market share from trucks through higher-quality service is

massive. Amazingly, over the last decade, rail revenue growth trailed

US GDP growth by nearly 50%, with

rail revenues stagnant

or even declining while U.S. GDP growth surged.

But Ancora’s plans, which essentially amount to doubling down on a

wildly unrealistic, exaggerated rip-off of PSR 1.0, threaten

to derail all the progress Alan Shaw has made towards

recapturing revenue growth. As Surface Transportation Board Chairman

Marty Oberman said

in no uncertain terms, “Clearly, Ancora’s plan is to

install a CEO ordered to reverse Norfolk Southern’s recently

instituted corporate strategy to maintain a resilient workforce and to

invest more in infrastructure to grow the railroad’s capacity long

term…Norfolk Southern has been one of the leaders in shifting gears

and building workforce and capital investment for the future. Now it

threatens to be punished for that activity by an activist investor.”

There is every reason to think that Alan Shaw has the right plan to

capture the benefits arising from the unique secular tailwinds

underlying the rail industry right now. If railroads can improve their

quality of service under PSR 2.0, with genuine investments into their

operations, as opposed to the myopic slash-and-burn of PSR 1.0,

railroads can drive revenue growth as a complement to, and not at the

cost of, increased efficiency, productivity, and safety. This is an

unmitigated win for all stakeholders, from shareholders to customers

to the general public.

A genuine track record vs. failing investors

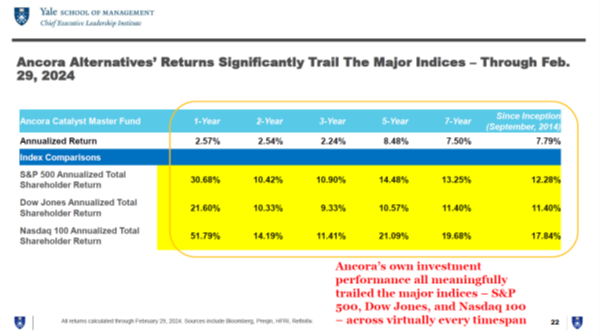

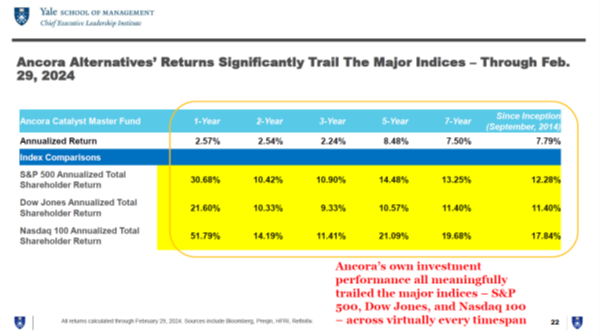

Despite the underperformance

of most activist funds, Ancora’s failures still stand out,

with the magnitude

of their underperformance striking even when

compared to

other underperforming

activist track records.

Not only has Ancora lost

many of its proxy fights,

but even more importantly, Ancora’s investment returns in its Ancora

Catalyst Master Fund have dramatically

underperformed all major indices (S&P 500, Dow Jones,

and Nasdaq 100)

and even Norfolk Southern stock itself across virtually every time

span we measured, as we

detail in our more comprehensive slide deck here. In fact,

an investor could have generated stronger investment performance from

low-yielding government bonds than Ancora’s

returns.

|

Despite Ancora’s dramatic

underperformance, and despite holding a puny

0.15% ownership stake in Norfolk Southern as of the end of

2023, Ancora had the audacity to nominate eight board members to the

13-seat board of Norfolk Southern. In short, Ancora has made

clear that they are after nothing short of engineering full control,

having repeatedly rejected

settlements proposed by Norfolk Southern’s board which would give

Ancora multiple board seats but not a majority. To have an

undistinguished minority investor with a 0.15% ownership stake, a

track record of underperformance, and no industry experience, demand

complete control and refuse reasonable settlements is a nearly

unprecedented situation for any company, and makes this proxy fight

substantively different than every railroad proxy fight before.

Unfortunately, rather than making their argument factually, Ancora has

resorted increasingly to shrill ad

hominem personal attacks. In a recent

CNBC interview, Ancora Alternatives President Jim Chadwick

said in no uncertain terms, “The problem is Alan Shaw,” attacking

the CEO in deeply personal terms and making it clear that

Ancora will settle for nothing short of his immediate ouster.

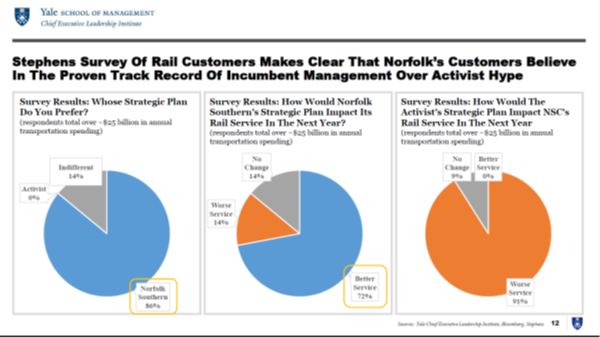

But evidently, to many Norfolk Southern stakeholders, the problem is

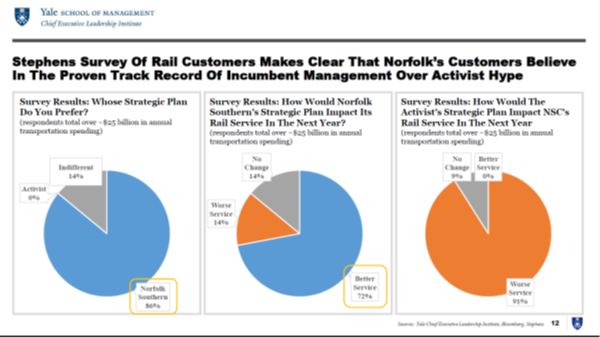

actually Ancora’s own activism leader, Jim Chadwick. In a recent Stephens

customer survey of dozens of rail customers representing over $25

billion in annual transportation spending, when asked

“Whose strategic plan do you prefer”, an overwhelming 86% of

respondents selected Alan Shaw’s, 14% were indifferent, and 0%

preferred the activist’s. Some 91% of respondents believed that

Ancora’s strategic plan would make Norfolk Southern’s rail service

worse in the next year, while 0% believed it would get any better. Not

exactly an inspiring show of support for Ancora from Norfolk

Southern’s key customers, who know you can’t “train on the job.”

|

Given the escalating unreasonableness of Ancora’s demands, perhaps it

is not coincidental that even one of Ancora’s

own director nominees has wisely withdrawn her name from

consideration, with perhaps more to follow. After all, few business

executives relish the prospect of draining ad hominem warfare. Perhaps

it is not coincidental that Ancora has lost

support even within fellow activists: Although Ancora had originally

trumpeted that it was cooperating with, and had the support

of EdgePoint Investment Group, a Toronto-based investor holding a 2%

ownership stake in Norfolk Southern, Ancora quietly

informed the SEC that EdgePoint had terminated all

cooperation with Ancora a few weeks back.

We sent our findings on Ancora’s underwhelming

returns to Jim Chadwick and his Ancora colleagues by email, but

despite acknowledging receipt, they never responded or engaged

further.

Some may think of railroads as an industry of

the past and the concept of railroad backroom battles may seem so

quaintly 19th century, but in reality, the centrality of railroads to

the 21st-century economy is underappreciated–and brings massive

potential for significant revenue growth.

It seems Norfolk Southern CEO Alan Shaw can

proudly sing the old folk song, ‘I’ve been working on the railroad all

the live long day,” with strong demonstrated results, despite the

noise from activist Ancora’s efforts to derail his success. Norfolk

Southern shareholders should cheer as this company pulls into the

station, guided by Alan Shaw’s steady hand, despite Ancora’s attempts

to derail Norfolk Southern through unrealistic promises.

Jeffrey Sonnenfeld is the Lester Crown Professor in Management

Practice and Founder and President of the Yale Chief Executive

Leadership Institute. In 2023, he was named “Management Professor of

the Year” by Poets & Quants magazine.

Steven Tian is the director of research at the Yale Chief Executive

Leadership Institute and a former quantitative investment analyst with

the Rockefeller Family Office.

© 2024 Fortune Media IP

Limited.