|

Enterprise

EXCLUSIVE WITH

MICHAEL DELL: It's Awesome To Be Private, PCs Aren't Dead, And

Chromebooks Won't Take Over The World

| |

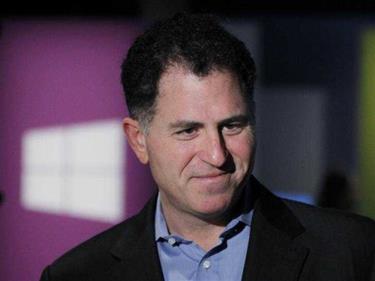

REUTERS

Michael

Dell.

|

We caught up with Dell CEO Michael Dell on Friday morning at the World

Economic Forum in Davos.

We had heard from one of Dell's investors a few days ago that the

company was thriving as a private company. Mr. Dell enthusiastically

confirmed that.

Dell says the Dell team is energized, reinvigorated, and aligned. He

says it is a great relief to be private after 25 years as a public

company. PCs aren't dead, he says, and Windows 10 looks cool. Dell's

debt is getting upgraded as analysts realize the company isn't toast.

Dell's software, server, and services business are growing in double

digits. And, no, Google's Chromebooks aren't going to take over the

world.

Highlights:

* It is a wonderful relief to be private after 25 years as a public

company. The

administrative hassles and costs are much less, and you have far

greater flexibility. You don't have to react to daily volatility and

repricing, and there's less distraction, so you can focus on your

business and team.

* Dell went public because the company needed capital — but these days

plenty of capital is available in the private market. Dell

went public in 1988, when Michael Dell was 23. Over the next 25 years,

the stock produced fantastic returns. But the one-two punch of the

financial crisis and concerns about the "death of the PC" poleaxed

Dell's stock and caused many people to write the company off for dead.

Dell thought it would be easier to retool the company in the relative

quiet of the private market, and he found investors willing to provide

all the capital he needed. He understands why red-hot emerging tech

companies like Uber, Palantir, Facebook, and Twitter don't go public

until they are very mature — they can raise all the capital they need

in the private market. There's no reason to subject yourself to the

headaches of the public market if you don't have to.

* Dell's new management team is energized and aligned around the new

mission — serving mid-market growth companies with comprehensive

hardware, software, and services solutions.

Some of Dell's old managers did not want to sign up for another tour

of duty, Dell says. After going private, Dell replaced these folks

with younger, hungrier executives who were excited to take on their

bosses' responsibilities.

* Dell's debt, which some doomsayers thought would swamp the company,

is now getting upgraded, as analysts realize Dell's future is much

brighter than they thought. S&P,

for example, recently raised its rating on Dell's debt to just

a notch below "investment grade."

* It turns out the PC isn't dead.

There are 1.8 billion of them out there, Dell says, and a big

percentage of them are more than four years old. Dell's PC business

got a bump from the retirement of Windows XP last year. Dell expects

there will be another bump from the launch of Microsoft's next version

of Windows, Windows 10.

* Windows 10 looks good so far.

Microsoft's most recent version of Windows, Windows 8, was a dud. No

one wanted to buy a PC to get it. (In fact, many people and companies

chose to avoid getting new PCs to avoid it.) Windows 10, in contrast,

looks like a positive step. It will most likely cause many older PC

owners to upgrade, driving some growth in the PC market.

* Dell isn't just PCs anymore! The

company's server, software, and services businesses are doing well,

Dell says. Server growth is up double-digits year over year.

* Google's ChromeBooks — cheap, stripped-down computers that don't run

Windows — are popular in some segments of the market, but they're not

going to take over the world. Dell

sells some ChromeBooks. They're doing well in some market segments,

like education. But Michael Dell thinks they may end up looking like

the netbook market of a few years ago. They sound great, at first,

especially for the low price of $249. But then many buyers find that

they don't do what they want or expect them to do.

* Copyright © 2015 Business Insider

Inc. |