|

Dell Settles Into Its Post-Public Persona

Dell

held its second annual analyst conference this week in Austin, and all

the cadres were on hand, the major firms like IDC,

Gartner, and Forrester, and

many smaller firms and independents. You might well ask, why bother,

since the stock is no longer traded and hasn’t been for a year and a

half? The answer would be, the company still needs to maintain a

conversation with the community, keeping it up to date on how things

are going.

It’s just that the makeup of the community is different

now. Gone, the days of pleasing Wall Street. Hello, customer base;

you know, the folks who pay the rent. And suppliers and partners who

provide components for and help put together the increasingly complex

and layered solutions Dell has on offer. And people like us, the tech

analysts who have covered the company for years and can put its

current trajectory in perspective.

Dell is behaving differently these days. It can invest

for the long haul to solve customer problems, taking less profit in

certain situations without having to explain itself to hungry

“investors.” In an environment of relative calm, employees can take

the long view, concentrate on customer needs, and execute cleanly.

|

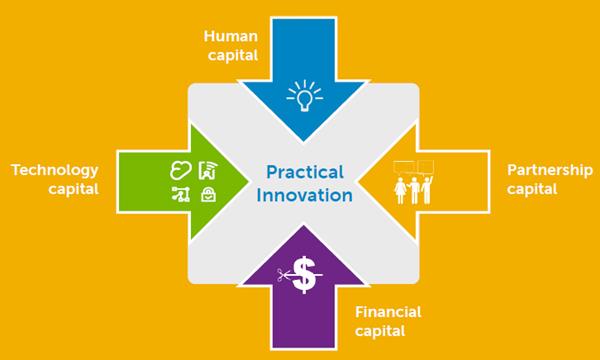

The four types of capital that

Dell applies to practical innovation

|

So, how is the company doing, freed as it is from its

bonds? (Well, actually, it still has some bonds, just no publicly

traded equity.)

Michael Dell, who owns 75% of

the stock (Silver Lake Partners owns the rest), says the company is

now able to maintain a higher risk profile and move more quickly. At

a reception, one of the managers recounted a story about asking him

permission to invest in a particular business and having him say, “Let

me ask my board of directors, management committee, and attorneys ….

sure, go ahead.”

Some of the analysts at the event noted that being

private doesn’t in itself lead to a higher risk profile. Those of us

who have worked at IDG, the private tech analyst and publishing firm,

know just how conservatively run that company is from an investment

perspective. Almost no business can be stood up without having its

own revenue stream already in place. Be that as it may, a private

company at least has the flexibility to consider a more aggressive

stance, and Dell has chosen to use its streamlined governance to

create a lighter-weight, more proactive organization, one more

responsive to its customers.

The presentation by CFO Tom Sweet was a bit surreal.

There were lots of metrics, but they all had immeasurable variables

associated with them. Revenue grew in the “mid-single digits” on an

unknown base. Operating income grew at a rate that was “exponential

above that.” I think it’s safe to say the company is making money,

particularly since one of the few concrete things Sweet did mention

was that it has already paid down $3.4 billion of its debt from the

management buyout. Clearly, something is working. At the rate this

is going, Michael Dell is going to be able to settle all the debt, buy

out Silver Lake, and hang onto the entire company free and clear.

Speakers and panelists at the conference bandied about

the tired buzzwords “innovation” and “solutions” a fair bit. But

there was grumbling in the hallways during breaks that the company

still has a relatively light software portfolio compared to rivals

like

IBM and

Hewlett-Packard, and most of

its solutions are heavy on elements contributed by third parties.

Probably the best spokesman for the company in this domain was Neil

Hand, who, as the vice president of Client Product Innovation, has one

of the buzzwords in his title. Hand, a hardware guy at heart, talked

about sexier materials and designs in the lineup, but he was clear

that “[Dell’s] primary role is integrating the innovations of

others,” In other words, Dell mostly provides the “glue” for elements

developed by partners. He gave as examples Samsung in OLED displays,

Sharp in “infinity edge”

displays,

Microsoft for custom coding,

and

Intel for power optimization.

Dell maintains a range of technology sources, including

straight-up suppliers, companies in which Dell has made an equity

investment, and outright acquisitions. But I did talk with some of

the software product people, who made a good case that there is plenty

of decent, home-grown development going on at the company. In

particular, John Thomson, general manager of Advanced Analytics, made

a solid case that Dell is leading in some areas of development. He

has been working with three acquisitions whose products are now well

bonded together with the local glue. Statistica, the new name for

StatSoft, an advanced analytics company Dell purchased in March 2014,

provides a platform that, after chewing on multiple complex data

sources, returns a probability factor that can be used to drive alerts

and other events. Boomi, an earlier acquisition, is a cloud-based

system that helps integrate those data sources for Statistica. And

Toad, also an acquisition, is used to manage (e.g., spin up and down,

copy, secure) some of the databases used by Statistica. I saw a fine

demo showing how all three have been integrated to predict hospital

admissions for asthma based on elements like patient history, weather,

pollen type and count, and a dozen other variables, including changes

in those variables over time.

Probably the most powerful case that Dell really does

have an creative engine was made by a panel called Practical

Innovation at Dell, which featured four managers with distinct but

interlocking roles. Jim Lussier, managing director of Dell Ventures,

represented financial capital; Jai Menon, chief research officer of

Dell Research, spoke for technology capital; Joyce Mullen, vice

president and general manager of Dell Global OEM Solutions, stood in

for partnership capital; and Elizabeth Gore, Dell’s

Entrepreneur-in-Residence, was the voice of human capital.

Lussier’s $300 million fund makes investments averaging

$3-5 million in companies identified as potentially disruptive and has

bought 25 such firms. He looks for “massive market opportunities” and

“passionate teams.” Gore’s expertise in the startup world makes her

an expert on what constitutes a passionate team. Menon tries to stay

ahead of developing technology trends, swinging organizational

attention toward promising areas. And Mullen manages the alliances

and partnerships that do joint engineering and get products to

market. Among them, they optimize Dell’s technology investments so as

to produce new products and solutions that customers actually want.

The company doesn’t do a lot of green-field R&D. Much of it starts

with a market need and works backward to figure out a way to address

that need.

Michael Dell himself presided over the event, giving

the opening speech and circulating at one of the receptions.

Recalling his earlier days, he has returned to wearing glasses, which

give him an intellectual look. His sideburns have grayed a bit more

in the past year. He was loose-limbed and relaxed and yet full of

energy. He timed the management buyout perfectly and is now

concentrating on turning the company with his name on the door into a

well-honed machine. No wonder he was in such fine spirits.

Disclosure: Endpoint has a consulting relationship with

Dell.

|