INTELLIGENT §

TRANSPARENT

§

GLOBAL

|

Giant money managers catch

Washington heat

Oct 15, 2024,

1:09pm EDT

business

|

World Economic Forum/Manuel Lopez

|

The

Scoop The

Scoop

BlackRock is under fire from a federal agency, which is itself a

target of Washington scrutiny, over its influence in corporate

boardrooms. It’s fighting back.

The Federal Deposit Insurance Corp. wants to impose sweeping limits on

how giant asset managers invest in US banks. The agency’s concern is

that BlackRock, Vanguard, and other big money managers wield too much

influence over lenders that decide what gets built in America.

The effort has the rare backing of both Republicans on the FDIC, who

think giant asset managers are too liberal, and Democrats, who think

they’re simply too big. Two defining forces in corporate America —

concerns over “wokeness” and monopoly power — are colliding, and the

ensuing fight is likely to touch on a third: private-sector backlash

against expanding

regulatory power.

The FDIC’s proposal to BlackRock and Vanguard, delivered Oct. 4, would

bar them from trying to influence a bank’s behavior by, for example,

nudging it away from financing oil projects — a nod to the past ESG

priorities of BlackRock CEO Larry Fink. It would also require them to

disclose any conversation their employees have with bank executives,

and to notify the FDIC every time they acquire more than 10% of the

shares of a bank — a level BlackRock already holds at about 40

lenders, people familiar with the matter said.

The FDIC “may request such additional information at its discretion,”

the draft agreement says, which has left executives concerned that

they’re signing up for a new permanent overseer. The agency set an

Oct. 31 deadline for BlackRock and Vanguard to sign the agreements

limiting their actions.

Without a deal by that date, BlackRock and Vanguard could be forced to

sell hundreds of millions of dollars worth of bank stocks — not ideal

for a sector still bruised from last year’s mini-crisis. The agency

can extend the deadline.

BlackRock executives pushed back in a call with FDIC staff in recent

days, the people said, arguing the rules are unworkable for funds that

trade in and out of positions frequently to match indexes. Some of the

rules would kick in at a 5% stake, which both BlackRock and Vanguard,

because of their sheer size, hold in nearly every public company.

The push shows how FDIC Chair Martin Gruenberg, who agreed in May to

resign after an investigation found pervasive sexual harassment at the

agency, is determined to govern right until the end. He has also

proposed new rules on deposits and is holding up a rewrite of new bank

rules for being insufficiently strict, Semafor

has reported.

On the asset manager front, current rules allow investors to own big

stakes in banks so long as they remain passive — although, as Jonathan

McKernan, the Republican FDIC director who proposed the new rules in

January, has pointed

out, it’s a loose system of self-reporting.

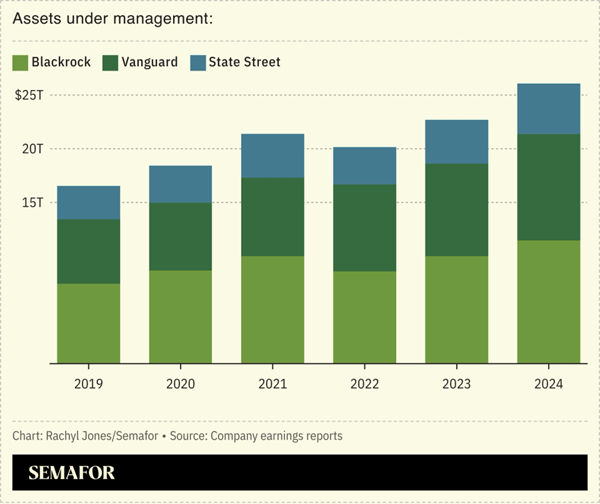

“The Big Three purport to be merely passive investors, but a growing

body of evidence suggests that’s not always the case,” he said in

a speech earlier this year, referring to BlackRock, Vanguard, and

State Street.

The FDIC and BlackRock declined to comment.

A Vanguard spokesman said: “Consistent with our mission and passive

approach, we have taken strong actions, engaged with policymakers, and

suggested additional reforms that further clarify and refine

expectations around passivity.”

Liz’s

view Liz’s

view

This seems like a solution in search of a problem. By BlackRock’s own

tally of its voting record, which is publicly available, it sided with

management in 1302 of 1304 items that appeared on banks’ annual

ballots since 2022, according to a letter it sent to the FDIC seen by

Semafor. Over that period, it bent the ears of executives over some

issue or another at just 12 banks. BlackRock engaged with 1,662

companies over the first half of this year alone. (To be

fair, the fact that it was able to give the FDIC those numbers

suggests that monitoring those meetings would not, in fact, be all

that onerous.)

But more broadly, BlackRock is getting out of the business of pushing

social causes on corporate boards as quickly as it can. It dropped out

of an alliance committed

to cutting carbon emissions and made it easier for fund investors to

vote their shares according to their own preferences. As the mood

around ESG has soured over the past two years, BlackRock CEO Larry

Fink, once

its most vocal proponent, has gone all but silent on the

topic. Vanguard, which was only ever lightly in moralizing business,

has also backpedaled.

When then-Sen. Pat Toomey published a report in 2022 that accused

BlackRock, Vanguard, and State Street of using “investors’ money to

advance liberal social goals,” he may have had a point, though a

quickly dulling one. When the House Judiciary committee accused them

of being part of a vast left-wing conspiracy, it

didn’t.

In 2021, BlackRock voted

to require JPMorgan to conduct a racial-equity audit, over

Jamie Dimon’s objections. This year, JPMorgan’s cause-cluttered ballot

included measures on racial equity, carbon emissions, indigenous

people, human rights, and animal welfare. BlackRock voted

against all of them.

Room for

Disagreement

Room for

Disagreement

“BlackRock’s extensive voting guidelines are

all about governance. I’m not sure there’s a way to be a truly passive

investor if you’re voting on director independence, over-boarding,

etc,” said Alex Thaler, CEO of Iconik,

which makes software that helps shareholders vote their shares. “Every

vote expresses a preference about how to create value or align with

values. You can’t get away from that.”

© 2024 SEMAFOR INC. |