|

Climate & Energy |

Securities Enforcement |

ESG Investors |

Boards |

Shareholder Activism

Vanguard bullish on proxy votes for

the masses

By

Ross Kerber

September 17, 20243:03 PM EDT

Commentary

| By Ross Kerber

|

The logo for Vanguard is displayed on a

screen on the floor of the New York Stock Exchange (NYSE) in New

York City, U.S., June 1, 2022. REUTERS/Brendan McDermid/File Photo

|

Sept 17 (Reuters) - The

opinions expressed here are those of the author, a columnist for

Reuters. This column is part of the weekly Reuters Sustainable Finance

newsletter, which you can sign up for

here.

Only 2% of Vanguard investors opted in to a pilot program to influence

their funds' proxy votes this year, the Pennsylvania-based asset

manager said, a low rate I thought might suggest its clients don't

care about corporate elections.

Not so, said John Galloway, Vanguard's global head of investment

stewardship. The paltry rate reflected the challenges of reaching a

vast customer base through intermediaries like brokerage firms,

Galloway told me and a group of other business journalists on Monday.

"We're committed to bringing this to scale," Galloway said on a video

call. He said to expect new pilot programs in 2025 as his team works

out technical solutions to communications problems. Eventually

Vanguard aims to offer proxy voting options to all its equity index

products, which account for $6.6 trillion of its $9.7 trillion of

assets under management.

Traditionally individual retail investors only vote about 30% of the

shares they own. That should be the natural rate for Vanguard's own

investors as well, Galloway said. "We're pretty bullish," he said.

Putting more proxy voting power in the hands of investors sounds great

in theory. But so far experiments by Vanguard, BlackRock,

and others have had little if any impact on corporate election

outcomes, said Bruce Goldfarb, president of proxy solicitor Okapi

Partners.

Investors, Goldfarb said, may be content to leave the process to their

asset managers. While there was a lot of early interest, "I think some

of that momentum has slowed as retail investors realize it's a lot of

work to vote their shares," he said.

Corporate elections have drawn increased attention since the financial

crisis as activists used them to pressure companies on environmental,

social and governance matters.

Some executives say regulators have given shareholders too

much power to shape the agenda of corporate annual

meetings.

The rush of assets into low-fee passive funds like the famed Vanguard

500 Index Fund has given their managers outsized

influence as major owners of top U.S. corporations. Their

size has raised concerns from

many sides, and giving clients more voting power could

reduce the heat.

Rather than allowing votes on individual companies, the funds'

programs mostly let investors chose the flavor of how their money is

voted. For instance last December Vanguard said under its "Investor

Choice" program it would allow investors in five funds with a combined

$100 billion to choose among four

policies to direct how their assets would be voted.

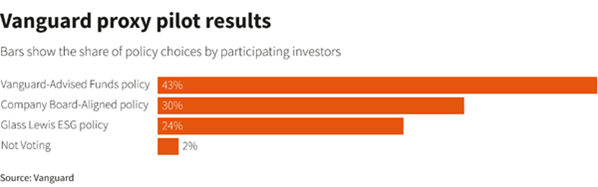

Of the 2 million investors eligible to participate, only about 40,000

signed up, Vanguard now says. Moreover, of that group, 43% selected

the option to vote as the Vanguard fund managers would have in any

case. Another 30% chose an option to vote as company boards

recommended - hardly a rock-the-boat message from the Main Street

shareholders Vanguard services.

|

43% of participants chose the Vanguard-Advised funds policy, 30%

chose the board-aligned policy, and 24% chose the ESG policy

|

|

Galloway said the data was still valuable as an answer to lingering

questions about what investors want.

He also noted how, not surprisingly, of the investors in the Vanguard

ESG U.S. Stock ETF who participated in the pilot, 78% chose an

ESG-friendly voting policy, more than three times the 24% rate at

which all pilot participants went with ESG.

In a report in

August, Vanguard said it did not back any of 400

shareholder proposals on environmental and social matters. Galloway

said that with more direct voting options, ESG-minded fund investors

will be able to express their views better.

“Over time, as we bring the Investor Choice program to scale, it will

be clear there is not a ‘Vanguard vote’, but rather votes based on

choices made by individual investors,” Galloway told me in a followup

e-mail.

Reporting by Ross Kerber; Editing by David Gregorio

|

Ross

Kerber

Thomson Reuters

|

|

Ross Kerber is U.S. Sustainable

Business Correspondent for Reuters News, a beat he created to

cover investors’ growing concern for environmental, social and

governance (ESG) issues, and the response from executives and

policymakers. Ross joined Reuters in 2009 after a decade at

The Boston Globe and has written extensively on topics

including proxy voting by the largest asset managers, the

corporate response to social movements like Black Lives

Matter, and the backlash to ESG efforts by conservative

politicians. He writes the weekly Reuters Sustainable Finance

Newsletter....

|

© 2024 Reuters. |