|

Climate & Energy

|

Securities

Enforcement |

US Elections

|

ESG Investors

|

Human Rights

Companies boost social and climate

reporting amid ESG backlash

By

Ross Kerber

November 6, 2024 4:54 PM EST

|

The One World Trade Center building

stands amid the Manhattan skyline in New York City, U.S., July 26,

2023. REUTERS/Amr Alfiky/File Photo

|

Summary

-

Most S&P 500 companies disclose diversity

data

-

LGBTQ+ survey responses at a record high

-

Lowe's, Ford to continue disclosures

Oct 31 (Reuters) - (This Oct. 31 story has been corrected to fix the

spelling of the name 'Shiva Rajgopal' in paragraphs 3 and 5)

Many U.S. companies have stepped up reporting on environmental and

social matters in recent years even with sustained pressure from

conservative politicians, data reviewed by Reuters shows.

The trend shows the importance investors and regulators now place on

environmental, social and governance (ESG) issues, analysts said, amid

rapid global warming and shifting workforce demographics. Some

political conservatives call the attention misplaced or worry the

disclosures could give activists leverage to force companies to make

unnecessary changes.

"Most ESG problems are business problems. I'm an accounting professor.

I can tell you that if you pick any company's 10K and look at the risk

factors, they are full of E and S problems," said Shiva Rajgopal, who

teaches at Columbia Business School.

The data contrasts with a some high-profile cases where companies have

dialed back ESG efforts such as working less with industry

climate efforts and

cooperating less with an LGBTQ+

advocacy group.

Many executives may be taking a wait-and-see approach until national

elections on Nov. 5 set a new balance of power in Washington, D.C.,

starting next year, Rajgopal said.

"If you're a company and something is getting you into trouble with

some constituents, it's simplest to back away from doing things that

seem risky for now and just stay put and wait until January and then

reassess," he said

Which party holds the White House and Congress could energize or

squash efforts to restrict ESG investing, a cause that has lagged

to date.

BE COUNTED

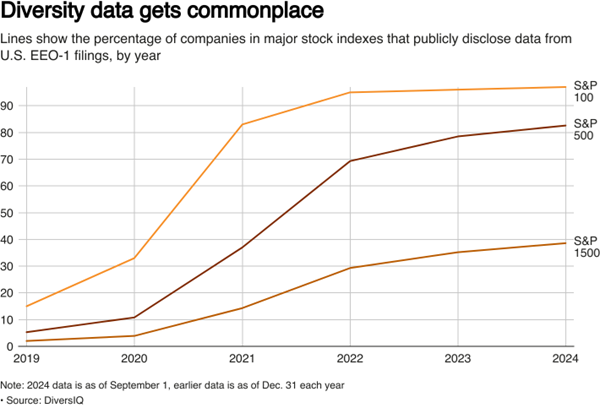

The share of S&P 500 companies making workforce data by race and

gender public rose to 82.6% as of Sept. 1 from 5.3% in 2019, according

to DiversIQ, which tracks diversity data for investors, consulting

firms and corporate clients.

|

Lines show % of companies publicly

disclosing data from their federal EEO-1 forms

|

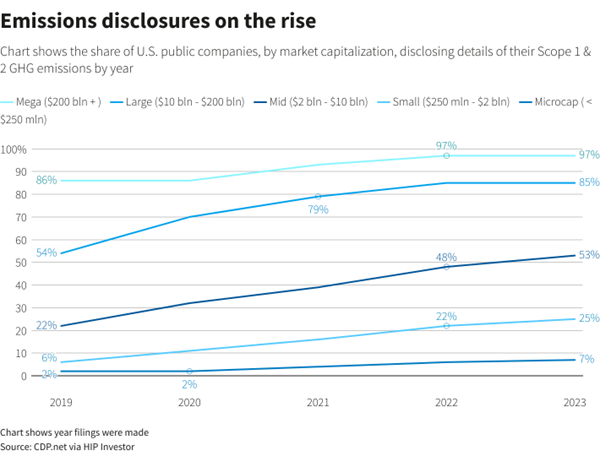

The number of U.S. companies sharing environmental data, meanwhile,

has also grown, with 85% of large-cap U.S. companies disclosing

details of their greenhouse gas emissions at the end of last year, up

from 54% disclosing in 2019, according to ESG investment advisor HIP

Investor.

|

Chart shows the percentage of companies,

by market capitalization, disclosing details of their Scope 1 & 2

GHG emissions

|

Obtaining public disclosures on ESG data has been a

focus of pro-ESG activist investors,

including Democratic public pension officials. The disclosure uptick

also shows boards responding to new rules like the European Union's

Corporate Sustainability Reporting Directive, said Ken Rivlin, partner

at law firm A&O Shearman.

Many companies also made public commitments around climate, pay equity

and workforce, details they cannot easily shift with the latest news

cycle.

"Establishing corporate policy in reaction to the latest pro- or

anti-ESG news story is not a recipe for success," Rivlin said.

KEEP THE REPORTS COMING

Various conservative politicians and social media figures have

targeted companies' diversity

efforts including

their links to LGBTQ+ advocacy group Human Rights Campaign, which

surveys companies on issues including same-sex partner benefits and

transgender healthcare.

In August, home improvement retailer Lowe's, said it would no longer

participate in the survey and restructured diversity efforts. A Lowe's

representative said at the time it would continue to report workforce

diversity and pay-gap

data that

investors had asked for.

A Ford representative said via email that "we will continue to

disclose our human capital management and DEI data" in an annual

sustainability report, but did not provide further details.

Despite the departures, more than 1,400 companies participated in this

year's survey, to be released in January, up slightly from 1,384 in

the most recent survey issued in November 2023, HRC said.

Companies "know that this is what their workforce and consumers

demand," said HRC President Kelley

Robinson.

Jeremy Tedesco, senior counsel for the Alliance Defending Freedom,

which calls itself a Christian law firm and opposes many corporate ESG

efforts, said pullbacks like those by Lowe's and Ford stand in

contrast to several years ago when many companies rushed

to align with

climate and social-justice activists.

Successful lawsuits targeting

corporate diversity policies based

on the 2023 U.S. Supreme Court ruling on college

admissions could

accelerate corporate changes, Tedesco said. "Unfortunately companies

went too far and there's a lot of course-correction," he said.

ON THE BACK FOOT

Many corporate climate disclosures stem from pressure from top

fund firms backing

shareholder resolutions. Since around 2021, however, investors have cut

their support including

State Street's asset-management

arm.

Like other investors, State Street said companies have already made

significant changes. "Disclosure has dramatically improved, especially

related to E and S issues over the past five years," said Ben Colton,

State Street's stewardship chief. "I'd imagine we'll continue to see

this kind of disclosure," he said.

Reporting by Ross Kerber in Boston. Additional reporting by Isla

Binnie in New York. Editing by Simon Jessop in London and Anna Driver

|

Ross

Kerber

Thomson Reuters

|

|

Ross Kerber is U.S. Sustainable

Business Correspondent for Reuters News, a beat he created to

cover investors’ growing concern for environmental, social and

governance (ESG) issues, and the response from executives and

policymakers. Ross joined Reuters in 2009 after a decade at

The Boston Globe and has written extensively on topics

including proxy voting by the largest asset managers, the

corporate response to social movements like Black Lives

Matter, and the backlash to ESG efforts by conservative

politicians. He writes the weekly Reuters Sustainable Finance

Newsletter....

|

|