|

New SEC guidance hits the Big 2,

BlackRock and Vanguard

By

Ross Kerber

February 26, 2025 2:34 PM EST

|

People are seen in front of a showroom

that hosts BlackRock in Davos, Switzerland Januar 22, 2020.

REUTERS/Arnd Wiegmann/File Photo

|

Feb 26 (Reuters) -

New restrictions on U.S. asset managers' stewardship will fall mainly

on industry leaders BlackRock and Vanguard, a new analysis shows.

The two firms together manage nearly $22 trillion, reflecting the

success of their low-cost passive funds. But their size has brought

criticism across the political spectrum and led to various new

regulations.

On February 11, the U.S. Securities and Exchange Commission tightened

guidance on reporting holdings for fund managers who pressure

management on environmental, social or governance (ESG) issues. The

guidance directs them to make a more complicated disclosure document

known as a 13D filing, rather than the simple 13G.

Critics worry the changes will silence

investors' voices by discouraging them from weighing in on

questions ranging from climate change to board structure.

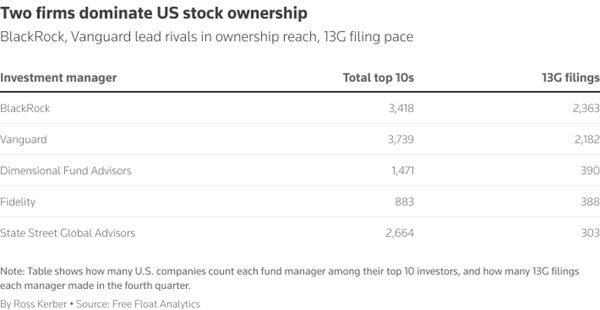

A review by Matt Moscardi, CEO of director analytics firm Free Float

Analytics, found that in the fourth quarter BlackRock filed 13G

disclosures for 2,363 of 4,529 publicly traded U.S. companies, and

Vanguard filed 13Gs for 2,182 of them, signs of their giant influence

across the economy.

After those two, the pace dropped far off, with Dimensional Fund

Advisors in third place having filed just 390 of the forms in the same

period.

Moscardi said the data underscores how the two firms have taken on a

massive role and can easily influence corporate elections with their

combined 10% or more of company shares.

It also means the new SEC guidance could have a big impact, even if it

mainly affects just the two firms, by dampening enthusiasm to press

for changes lest a company challenge their status as a 13G filer.

"My guess is that to not have companies challenge them, they have to

take a softer touch," Moscardi said. The firms might ask about a topic

but might not be able to press for changes such as annual board

elections, even though their voting policies suggest that.

A big question, he said, is whether a company would petition the SEC

to declare BlackRock or Vanguard an activist if either firm asks a

board about a topic, gets a dismissive answer and then votes contrary

to management's wishes.

"The companies are sitting in the drivers' seat on engagement," he

said.

Neither BlackRock nor Vanguard commented for this article.

Both companies paused their stewardship meetings with portfolio

companies while digesting the new guidance, although BlackRock said

last week it has resumed

the get-togethers. The New York firm also said "we are complying

with the new requirements including by highlighting our role as a

'passive' investor at the start of each engagement."

Ropes & Gray attorney Marc Rotter said smaller asset managers also

could still face challenges with the new guidance. It is too soon to

tell how they might respond.

"I don't think the issue is limited to the largest asset managers.

There's a greater number where the issues might be salient for a few

positions, even if they're not filing a lot" of disclosures showing

greater than 5% ownership, he said.

Reporting by Ross Kerber; Editing by David Gregorio

|

Ross

Kerber

Thomson Reuters

|

|

Ross Kerber is U.S. Sustainable

Business Correspondent for Reuters News, a beat he created to

cover investors’ growing concern for environmental, social and

governance (ESG) issues, and the response from executives and

policymakers. Ross joined Reuters in 2009 after a decade at

The Boston Globe and has written extensively on topics

including proxy voting by the largest asset managers, the

corporate response to social movements like Black Lives

Matter, and the backlash to ESG efforts by conservative

politicians. He writes the weekly Reuters Sustainable Finance

Newsletter....

|

|